Now the biggest news of the week - to respond to Chase Sapphire Reserve, Amex revamps its iconic Platinum Card, both the personal and business versions, and the changes were effective October 6, 2016. Also Amex brings back the amazing 100K offer for the Business Platinum Card. Please head over to our Amex Platinum Card Review for everything you will need to know about it, including the 100K offer for the business card. Here we will highlight the changes.

Amex Platinum Card (personal): 5x Membership Rewards (MR) points on airfare booked with airlines or through Amex Travel website. When you book airfare via a third party Online Travel Agency such as Expedia, Travelocity, Ortiz, most likely you will be charged directly by the airline so you will still receive 5x points. Note previously, this card gives 2x points on certain travel (airfare, prepaid hotels, vacation packages, cruise) booked through Amex Travel, and the booking fees are waived for Platinum members. Looks like this feature is still available but the airfare will earn 5x instead, while other travel continues to earn 2x. The last thing to note is that while Amex Platinum has the highest level of travel protection among all Amex cards, it still trails behind Citi and Chase in this regard, as Amex doesn't cover family members or award tickets and doesn't offer Trip Cancellation/Interruption, Trip Delay, or Baggage Delay coverage. This factor might make some travelers use Citi Prestige or Chase Sapphire Reserve for 3x airfare instead of 5x on Amex Platinum.

While Amex Platinum's $450 annual fee may seems hefty, when you make use of the $200 annual airline credit, the effective annual fee becomes $250. Most savvy card members probably won't use this card for general purchases, as there are better alternatives out there, such as Amex EveryDay Preferred, Amex SPG, Fidelity Visa, Citi Double Cash, just to name a few. However, the October 2016 enhancement turns this card into a powerhouse for bonus rewards - 5x airfare is the highest among all miles/points cards. Using our current conservative value of 1.5 cents per MR point, you are getting 7.5% cash equivalent rewards on airfare purchases. You only need to spend $4,600 a year on airfare to beat the $250 effective annual fee and 2% cashback, because $4,600 x (7.5% - 2%) > $250. You will need to spend $8,400 a year on airfare to beat the $250 effective annual fee and a miles/points card that offers 3x on airfare such as Amex Premier Rewards Gold, Chase Sapphire Reserve, Citi Prestige, because $8,400 x (5 - 3) point/$ x 1.5 cent/point > $250. After that, you essentially receive all Platinum Card's great travel perks for free, such as unlimited access to Delta, Alaska, Centurion, and many more domestic and international lounges, Fine Hotels and Resorts, Hilton/SPG/Marriott Gold, and many others. If you frequent Delta or Alaska and/or depart from a city where there is a Centurion Lounge, this card offers unparalleled value. If you frequent Hilton Worldwide, Starwood Hotels & Resorts, Marriott International, and/or luxury hotels, this card could also be hugely valuable.

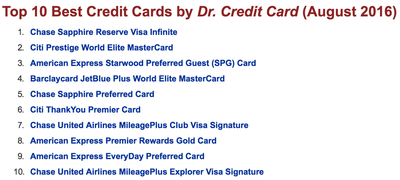

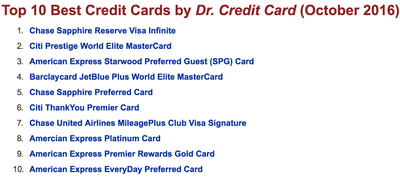

With this important enhancement and its already impressive perks (rated #2), signup bonus (currently 40K), and protection, Amex Platinum finally makes to our Top 10 Best Credit Cards list, even surpassing the other two longtime favorite MR cards - Amex Premier Rewards Gold and Amex EveryDay Preferred. As a result, the previous #10 Chase United Explorer Visa falls off the list. Please see below the screenshots of the list before and after October 6, 2016.

Amex Business Platinum Card: (1) 1.5x points on each purchase of $5,000 or more, (2) 50% points rebate when using the "Pay with Points" option, essentially making MR points fixed value at 2 cents a piece, when buying First or Business Class tickets with any airline through Amex Travel, and Economy Class tickets with your selected airline also through Amex Travel. So the 100K signup bonus of Business Platinum Card is worth at least $2,000!

Note that you may still choose the other valuable redemption option to transfer MR points to miles/points of several frequent traveler programs, and keep in mind that our current value of MR points for using that option is 1.5 cents a piece, lower than the "Pay with Points" option. However, these two options are very different in nature, I personally will choose the transfer option even with lower on-paper value, as I know I won't be using my hard earned cash/points to buy international long-haul First or Business Class tickets outright, while transferring points to miles of a frequent flyer program will allow me to have such tickets at a very reasonable rate. Let's see an example of a recent flight I took: the one-way Suite Class on Singapore Airlines between Tokyo Narita and Los Angeles retails at about $8,000, and if I were to use the "Pay with Points" option, I will need a whooping 400,000 MR points - at exact 2 cents per point value. However, if I would transfer 74,000 MR points to Singapore miles, I would be able to book this award ticket with the miles + $130 taxes and fees, as long as I find an available seat. In fact, I did not use my MR points but I transferred my Citi ThankYou points to Singapore miles and I was able to secure not only one seat but two. If I do math on paper, the value of MR points will be more than 10 cents per point; however, my personal conservative value of them is still around 1.5 cents, as I am willing to pay $1,250 for this ticket (74,000 points x 1.5 cent/point + $130 = $1,250).

Let's come back to see what the changes mean for Business Platinum Card member. Earning 1.5x points on large purchases (>$5,000) will of course help some members. However, the enhanced "Pay with Points" is more interesting to most members, as this makes Business Platinum Card a 2% rewards card for general spending with a $250 effective annual fee. In addition, it opens up opportunities for other MR cards to become more valuable as MR points will be pooled together automatically. For example, EveryDay Preferred will return staggering 9%, 6%, and 3% rewards for grocery, gas, and general purchases; the personal Platinum Card will return 10% rewards for airfare; Premier Rewards Gold Card will return 6% and 4% rewards for airfare and gas/grocery/dining.

© 2016 DrCreditCard.net All rights reserved.

RSS Feed

RSS Feed