On April 16, 2018, Marriott International announced that it will finally combine three of its loyalty programs (Marriott Rewards, Ritz-Carlton Rewards, Starwood Preferred Guest) into one this coming August. Please see the details on Marriott’s website. Here are our thoughts on this big moment in the history of loyalty programs in a high-level overview.

Points Value

Effectively August 2018, if you are currently a member in more than one of their programs, your accounts will be combined as one. Your Starwood Preferred Guest (SPG) points will be converted into Marriott points at 1:3, which is not surprising because this has been your option since the Marriott-Starwood merger.

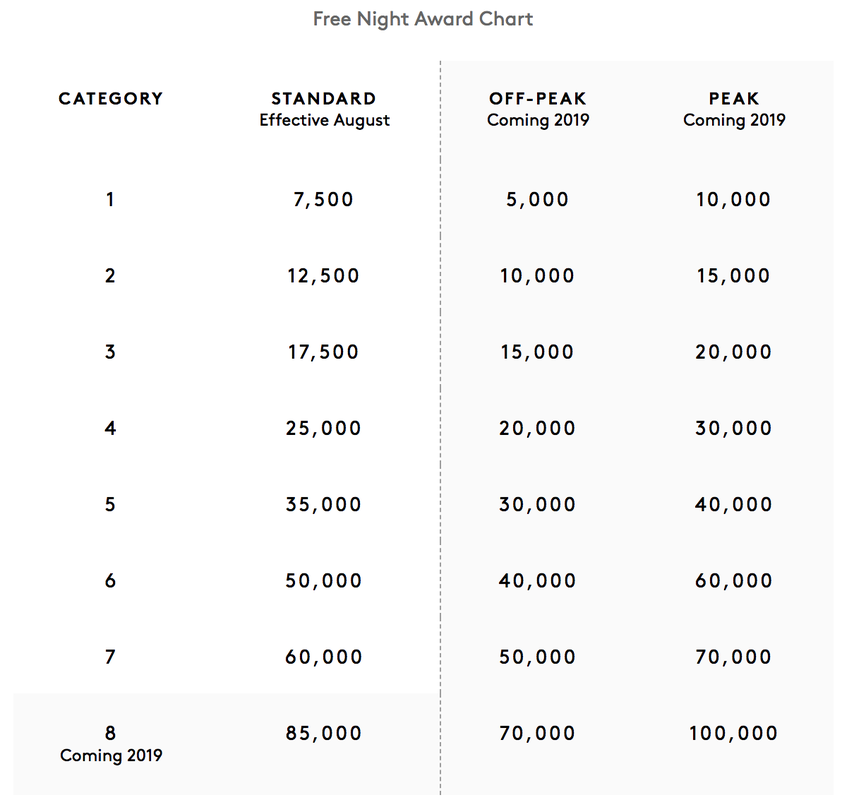

Marriott will have a new hotel rewards chart for all its 29 brands, with 8 categories, each of which will be seasonally adjusted with three redemption levels - off-peak, standard, and peak. See the summary table below for details. In general, whether the change will be considered an enhancement or devaluation depends on the actual placement of the total 6,500+ hotels in the new chart. We are not a big fan of the seasonally adjusted model, as in our opinion, it gives more benefits to the properties usually at the cost to the members. However, one great deal of this development is that because the Category-8 pricing and the seasonal adjustments won’t take effect until 2019, from August through the end of 2018, you will be able to redeem for the top-tier properties at a flat rate of 60K Marriott points per night (based on the new Category-7 standard pricing); for your information, top-tier Ritz-Carlton and EDITION hotels now require 70K per night, and top-tier Starwood hotels (mostly under St. Regis, Luxury Collection, and W brands) require 30K-35K SPG points, i.e., 90K-105K Marriott points.

In general, on points value of the new program, even with some uncertainties in the new hotel chart (which we suspect to be slight devaluation overall), due to the fact that Marriott retains the valuable miles transfer feature, we are very much pleased.

Elite Status

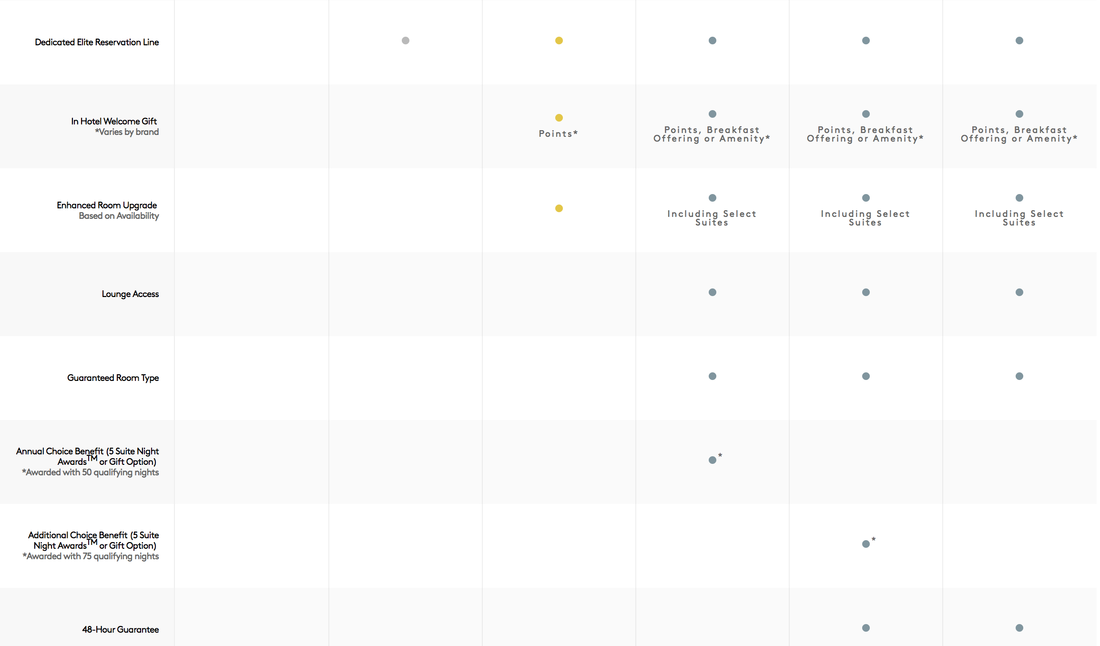

Effectively August 2018, Marriott will have five tiers of elite status. Please see below for a summary of elite status under the new system. In general, we think it is very reasonable, similar to status quo for current SPG elites, and an overall enhancement for current Marriott elites.

Credit Cards

There are currently a total of seven credit cards associated with the three loyalty programs, and in the near future two new products are on the way:

- Chase Marriott Premier Plus Visa ($95 annual fee, 6x Marriott | SPG and 2x everywhere else, an annual free night capped at 35K points, 15 night credits per year) represents a decent enhancement over the current $85 Marriott Premier Visa.

- Amex SPG Luxury Card ($450 annual fee, annual $300 credits for eligible Marriott | SPG purchases, 6x Marriott | SPG, 3x dining and airfare, 2x everywhere else, an annual free night capped at 50K points, complimentary new Marriott Gold status, new Marriott Platinum status with $75K annual spending, 15 night credits per year, unlimited access to airport lounges for you plus two with Priority Pass Select membership) is a potential great product to compete with Amex Hilton Aspire Card.

It appears that in August 2018, six cards are here to stay for new applications: Chase Marriott Consumer Card ($45), Chase Marriott Premier Plus Visa ($95), J.P. Morgan Ritz-Carlton Visa ($450), personal Amex Marriott Card ($95, rebranded from Amex SPG Card), Amex Marriott Business Card ($95, rebranded from Amex SPG Business Card), and Amex Marriott Luxury Card ($450, rebranded from Amex SPG Luxury Card). Existing cardmembers of other products will be keeping their current cards with some changes kicking in as of August; at this point, we don’t know whether these cards will be converted to other products in the future. Among the changes, we would like to highlight that our beloved Amex SPG Card, which now returns 1 SPG point (=3 Marriott points) per dollar spent on general purchases, will be returning only 2 Marriott points come August and not worth keeping in our opinion.

RSS Feed

RSS Feed