- Annual Fee: $95

- Signup Bonus: two Welcome Flight Rewards Certificates (up to 50,000 points each - if your award requires less than 50,000 points you won't receive the difference back; won't expire as long as your account is open; as you might use additional Aeroplan points to pay for the difference when your award requires over 50,000 points, this signup bonus is pretty close to 100,000 Aeroplan points) after spending $4,000 within the first 3 months of new account opening. In addition, you receive Aeroplan 25K status (Aeroplan's entry level elite status) for the remaining of the calendar year when you open the new account plus the next calendar year.

- Rewards: 3x Air Canada & groceries & dining, and 1x everywhere else. You also earn 500 bonus points for each $2,000 spent in a calendar month, up to three times per month.

- Perks: it is packed with Aeroplan specific benefits, as well as World Elite MasterCard benefits.

- Protection: decent level of travel and consumer protection.

- Our analysis: when it comes to spending, even though Chase Aeroplan offers good rewards, especially in bonus categories, we recommend looking into some other excellent options such as Capital One Venture X, Chase Sapphire Reserve, Amex EveryDay Preferred, and Amex Gold. However, it you can take advantage of Aeroplan specific benefits, you will find this card still amazing as a whole package. As a result of it strength in signup bonus (#7), rewards (#8), and decent performance in perks and protection, it is now rated #3 Best Credit Card.

- The before and after Top 10 list:

|

Chase Aeroplan World Elite MasterCard is now rated #3 Best Credit Card by Dr. Credit Card. As you may use Aeroplan points on Air Canada or its partner airlines (Star Alliance) including United Airlines, it could be a good card for U.S. consumers for travel awards within U.S. and worldwide.

1 Comment

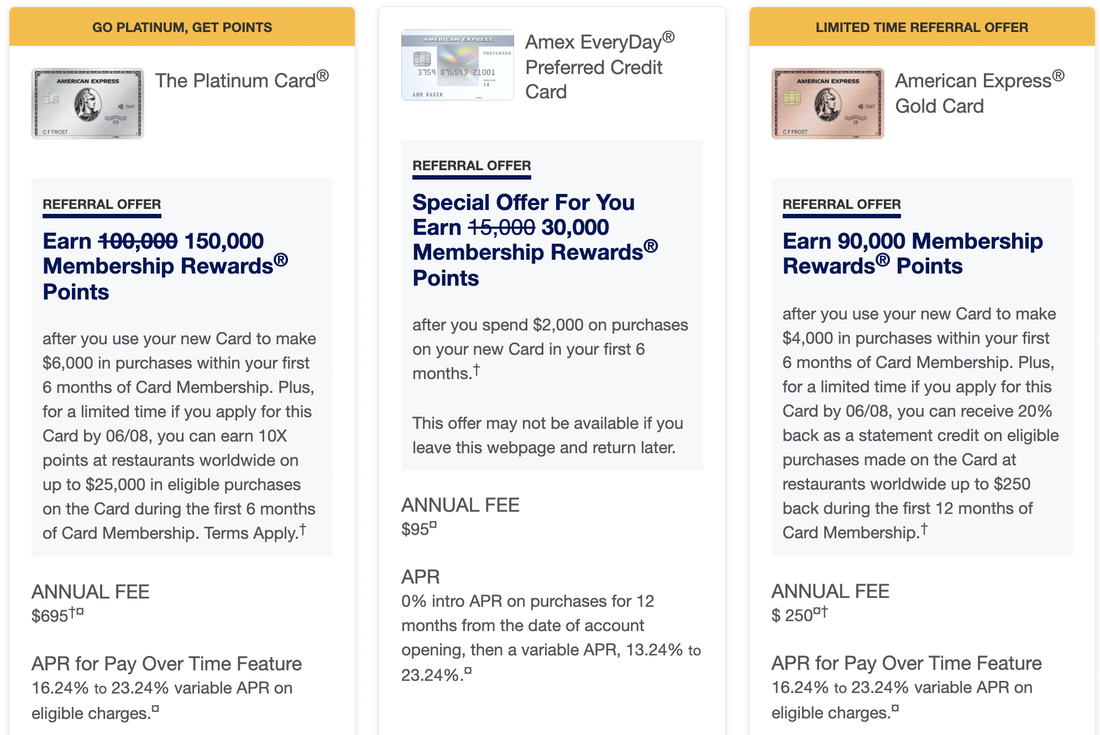

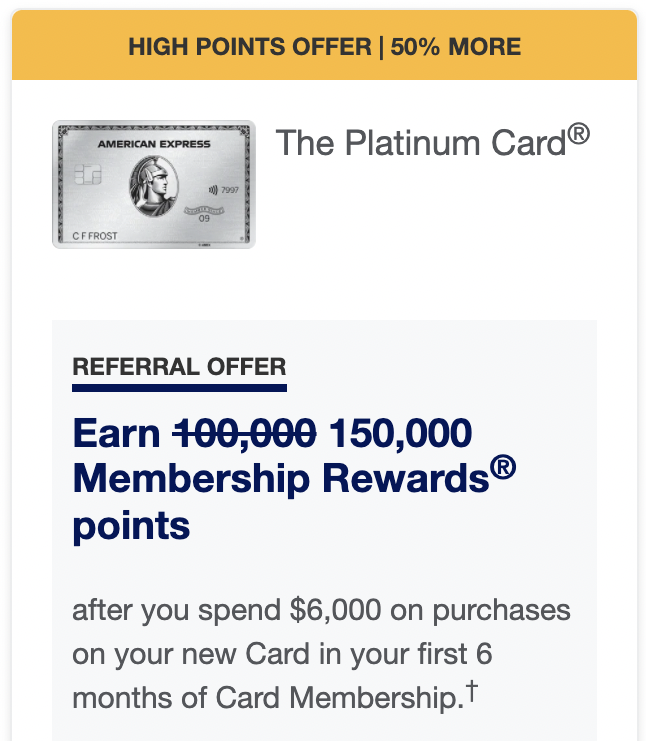

It appears that we have seen some best signup bonuses ever on the two very popular Amex charge cards. These offers are via referral links and now definitely better than the ones on Resy.com (Amex partner website), which again are much better than Amex's own website. Keep in mind that some of these referral links show different results based on your browser setting and sometime simply the time you visit - it is recommended to visit the links in the private browsing mode of your browser; sometimes, you might need to try multiple times to see them; sometimes, clearing caches/history in your browser helps too.

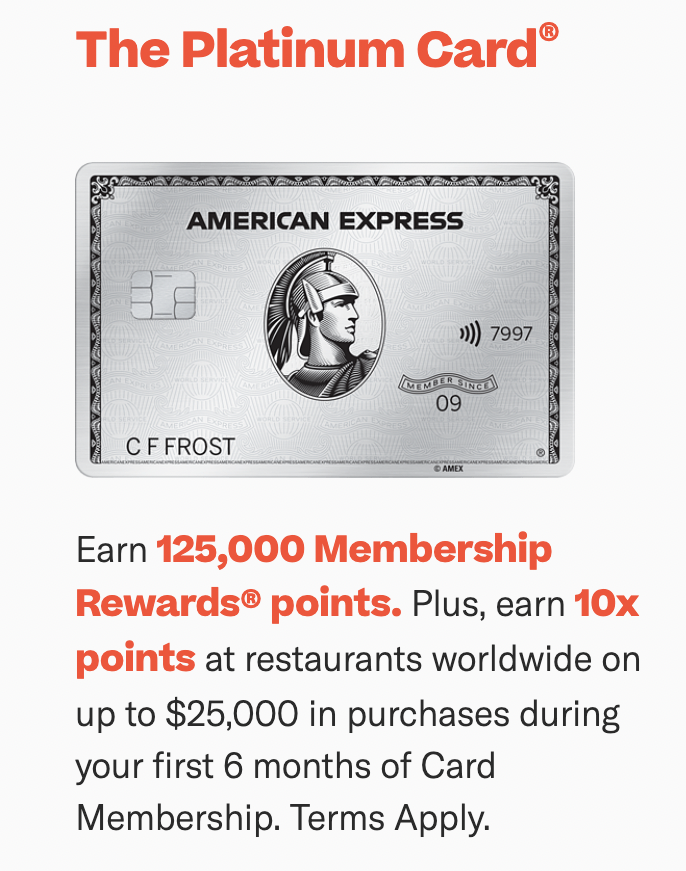

In 2021, Amex had arguably the best offer ever for its iconic Platinum Card via Resy: 125,000 points with $6K spending requirement + 15x points on dining for the first 6 months. In 2022, we still have two very amazing offers that are pretty close to historical best:

The last thing to note is that Amex BUSINESS Platinum Card also offers 150,000 points at this time, but with a much more difficult spending requirement ($15,000 within 3 months). |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed