- Citi Premier has seen the best signup bonus ever - 80,000 ThankYou points with a $95 annual fee (our value $1,105).

- Citi Prestige has been pulled from Citi website and is discontinued to new applications until further notice. There are two possibilities: one is that it will be gone for ever as Citi might exit the fierce high-end card market, and the other is that Citi might be working on a major revamp and will bring it back at some point in the future. We might have to pull it from our Top 10 list pending further confirmation.

- Chase IHG Premier WEMC also offers the best ever - 150,000 IHG Rewards points with the 1st annual fee waiver (our value $600).

- Barclays Wyndham Visa cards also hit historical high: 60,000 Wyndham Rewards points on earner Visa, 90,000 points on either earner+ Visa or earner Business Visa. Our valuation for these three offers are $470~$625.

|

0 Comments

Chase introduces more temporary bonuses to its credit card portfolio for November and December 202010/31/2020 Chase has introduced temporary benefits on more of its credit cards. In a recent post, we covered Chase Sapphire series, Ink series, and Freedom series. Now select cardmembers will receive the following category bonuses between 11/1/2020 and 12/31/2020; you need to activate the offer through a link in the promotional email or at chase.com/mybonus directly.

In addition, not from Chase or Amex, the following hotel program policies are recently announced:

Finally, to track all the COVID-19 related temporary credit card benefits, please visit our featured review which has been under continuous update with the most recent updates highlighted in cardinal. COVID-19 pandemic has obviously changed consumer behavior big time, and it makes sense that credit card issuers are making adjustments accordingly. This post summarizes these adjustments from Amex, Chase, and Citi.

American Express

Chase

Citi

There are quite a few updates on the website in the recent weeks, and here is a quick roundup.

This week we have seen some elevated signup bonuses on a few credit cards (our value for the bonus minus first year annual fee is for your reference - your valuation may vary):

Chase IHG Rewards Club Premier World Elite MasterCard now has a 105K + $50 credit signup bonus, the best we have ever seen on this card or the card it replaced (IHG Rewards Club Select MC). The $89 annual fee is not waived for the first year. The signup bonus: $50 statement credit after the first purchase + 100,000 points after spending $3,000 within 3 months of new account opening + additional 5,000 points after adding one authorized user and making the first purchase within the same 3-month period. The bonus is not available if you currently have this card or have received a signup bonus for this card in the past 24 months. Note that this card is NOT subject to Chase' infamous 5/24 rule (you won't be approved for a new card if you have opened 5 or more new accounts within the past 24 months).

So do you apply now?

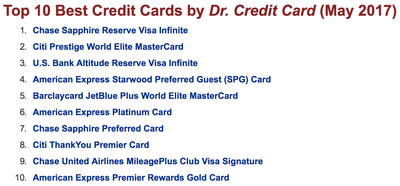

July 23, 2017 has been a daunting date for many Citi Prestige cardholders for about a year, since over a year ago, Citi announced the (mostly negative) changes that would come to Citi Prestige as of this date. Now the changes finally kicked in: (1) American Airlines Admirals Club access is gone; (2) ThankYou (TY) points fixed value flight redemption has gone down from 1.6 cents per point (cpp) on American flights and 1.33 cpp on other airlines to 1.25 cpp across the board; (3) three rounds of free golf is gone; (4) 4th Night Free feature is based on the average rate over the entire stay rather than the actual rate of the 4th night (taxed will also be excluded in the statement credit), and you may now book hotels through ThankYou.com, in addition to calling Citi Concierge. Citi threw in some enhancements: a new metal card design (everyone else in the high-end market has had this for a while), increased cash rewards from 0.5 cpp to 1 cpp (cashing out is not the best option to redeem TY points anyway), and the best ever signup bonus of 75,000 points (we don't know how long it will last though). Obviously, we consider this as a major devaluation of this once dominating player in the high-end card market. It drops out of the Top 10 Best Card for Rewards (previously #9; our valuation of TY points earned from Citi Prestige has gone down from 1.6 cpp to 1.5 cpp, as the flexible feature that allows points to be transferred to frequent flyer programs such as Cathay Pacific, Singapore, Flying Blue, Etihad, etc. remains untouched). Citi Prestige's position on the Top 10 Best Cards for Perks also changes from #3 to #7. As a result, even the increased signup bonus doesn't prevent Citi Prestige from dropping one position on our Top 10 Best Credit Card list, surpassed by U.S. Bank Altitude Rewards. At the same time, another Citi card - ThankYou Premier is gaining ground with the increased signup bonus from 30K to 50K. ThankYou Premier is now #4 Best Credit Card by Dr. Credit Card, right behind its big brother. Here are the snap shots of our Top 10 list before and after the changes. In the last several weeks, even with some slow down, we have still been able to have some updates throughout the site, including increased signup bonus on Chase IHG Visa (from 60K to 80K), decreased signup bonus on Amex Delta SkyMiles Gold and Platinum Cards, etc. Here we would like to highlight Chase Hyatt Visa's change. Since the end of June 2017, Chase Hyatt Visa's signup bonus has been up 40,000 points, changed from the long-lasting two free nights at any Hyatt hotel worldwide.

In the past, Chase Hyatt Visa's bonus was considered extremely lucrative, as you may redeem free night certificate toward the most expensive properties that are consistently retailed for at least $800 per night (Park Hyatt New York, Park Hyatt Paris-Vendôme, Park Hyatt Milan, Park Hyatt Maldives Hadahaa, Park Hyatt Sydney, and the soon opening Park Hyatt St. Kitts). The following hotels are also great alternatives and they mostly retail for at least $400-$700 per night: Park Hyatt Zurich, Park Hyatt Vienna, Ararat Park Hyatt Moscow, Park Hyatt Changbaishan, Palacio Duhau - Park Hyatt Buenos Aires, Park Hyatt Tokyo, Andaz Tokyo Toranomon Hills, Andaz New York 5th Avenue, Andaz Maui at Wailea Resort, Andaz Mayakoba Resort Riviera Maya, Hyatt Carmel Highlands, Hyatt Zilara Rose Hall, and Hyatt Ziva Rose Hall. These are either Hyatt's Category-7 (requiring 30,000 points per night) or Category-6 (requiring 25,000 points per night) hotels. So the previous signup bonus can be considered as worth 50,000 - 60,000 points with a caveat that the free night certificates expire after 12 months of issuance. The current signup bonus is obviously smaller at 40,000 points, but you do have the flexibility of using them at any time of your choice and also at any Hyatt hotel of your choice. The bottom line? The previous bonus of two free nights are obviously worth more when you redeem them towards aspirational properties within a year, and the current bonus of 40,000 points offers more flexibility. Amex has been running 75K signup promotions for its Business Gold Rewards Card, one of our Top Listers, for a long time and they have always been limited time offers (sometimes lasted only one day). Earlier this year, Amex has been keeping a link for a similar offer for widely targeted customers. You will need to visit the link below and log into your Amex account to see if you qualify for 75,000 points. If you receive an error then you probably don't qualify. You will need to spend $5,000 within 3 months of new account opening to receive 75,000 Membership Rewards points, which can be transferred to miles/points of Delta, Hawaiian, Air Canada, British, Singapore, Cathay Pacific, ANA, and many other airline or hotel partners. As always, the $175 annual fee is waived for the first year.

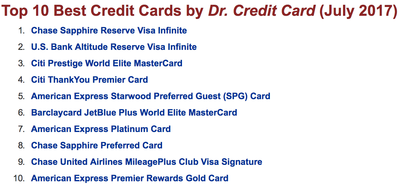

Landing Page © 2015 DrCreditCard.net All rights reserved. Amex has a promotional offer for one of our Top Listers Premier Rewards Gold Card - you will receive 50,000 Membership Rewards points after you open a new account and spend $1,000 within 3 months. The regular offer is 25,000 points. The first year annual fee is waived, saving $195. Please note that the signup bonus will NOT be given if you have or previously had this product.

However, there is no public link that works for everyone. Amex has recently been trying something new when offering a signup promotion to customers. Looks like that people may get different offers when visiting Amex website. Don’t worry, if you follow the following steps, you will most likely get the 50K offer on the PR Gold:

Also for a limited time, Amex is also running a promotion offer for its Platinum Card - you will receive 100,000 Membership Rewards points after you open a new account and spend $3,000 within 3 months. The regular offer is 40,000 points. The $450 annual fee is NOT waived. Steep the annual fee may seem, after taking advantage of the $200 annual airline credit, your effective annual fee becomes $250 and you could enjoy some very valuable perks such as airport lounge access, Fine Hotels and Resorts, reimbursed Global Entry application fees, etc. That is why it is not only on our Top List, but also recommended as one of cards worth paying annual fees without spending. Please note that the signup bonus will NOT be given if you have or had this product. You can follow similar steps listed above; however, the 100K offer on the Platinum Card is much harder to come by - you may need to try dozens of times. If you prefer calling Amex instead, you can give them the POID code BUIU:0001 and they will be able to find the 100K offer for you. © 2015 DrCreditCard.net All rights reserved. Chase has had 60,000 points bonus offer for Ink Plus in branch. Late last month, it made a similar offer online and now we are in the last week of this limited time offer which ends June 25, 2015. You need to spend $5,000 within 3 months to get the signup bonus and the first year annual fee is waived (saving $95). Chase Ultimate Rewards points can be redeemed for travel at 1.25 cents per point and the signup bonus could be worth $750. Ultimate Rewards points can also be transferred to 10 airline/hotel partners' miles/points and your value may be even higher.

Landing page Application page |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed