- A few more recent good signup offers.

- Chase Sapphire Reserve now offers 80,000 points at signup - the second best offer after the initial incredible 100,000 points when introduced in 2016.

- Citi AA Executive WEMC offers 80,000 miles - the second best offer after 100,000 miles a few years ago.

- Barclays AA Aviator Business MC offers 80,000 miles + $95 credit - the historical high.

- Barclays Miles & More MC offers 80,000 miles - the historical high.

- With some changes in signup bonuses (we look at the historical trend in the recent couple of years) and rewards program valuation, our Top 10 list received some slight updates. Below is the before and after comparison. As you can see, Sapphire Preferred and Aeroplan MC switch places, while Hilton Aspire Amex replaces Barclays JetBlue Plus as the No. 10 card on the list.

|

1 Comment

Our featured review is aimed to summarize the temporary credit card benefits during the COVID-19 pandemic and we have some new updates. The entire post is copied below with the current offers highlighted in cardinal.

Updated May 16, 2021. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. Note that while some benefits are applied automatically, some benefits require activation through a link or via online account. The current offers are highlighted in cardinal. American Express

Bank of America

Barclays

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2021 DrCreditCard.net All rights reserved. There have been more temporary credit card benefits announced recently, mostly on Amex cards. Via Amex Offers, Amex introduced $10-$20 monthly dining credits for a few personal co-branded cards and $10-20 monthly wireless credits for a few business co-branded cards. In addition, on personal Marriott and Hilton cobranded cards, there are some bonus points opportunities for general spendings. We have updated the featured review accordingly and also pasted everything over here. As always, the new benefits are highlighted in cardinal.

Updated February 15, 2021 COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. Note that while some benefits are applied automatically, some benefits require activation through a link or via online account. American Express

Bank of America

Barclays

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2021 DrCreditCard.net All rights reserved. Throughout this pandemic when many card issuers have been bringing temporary benefits or bonuses to keep their existing cardmembers, Barclays has been quiet, until now.

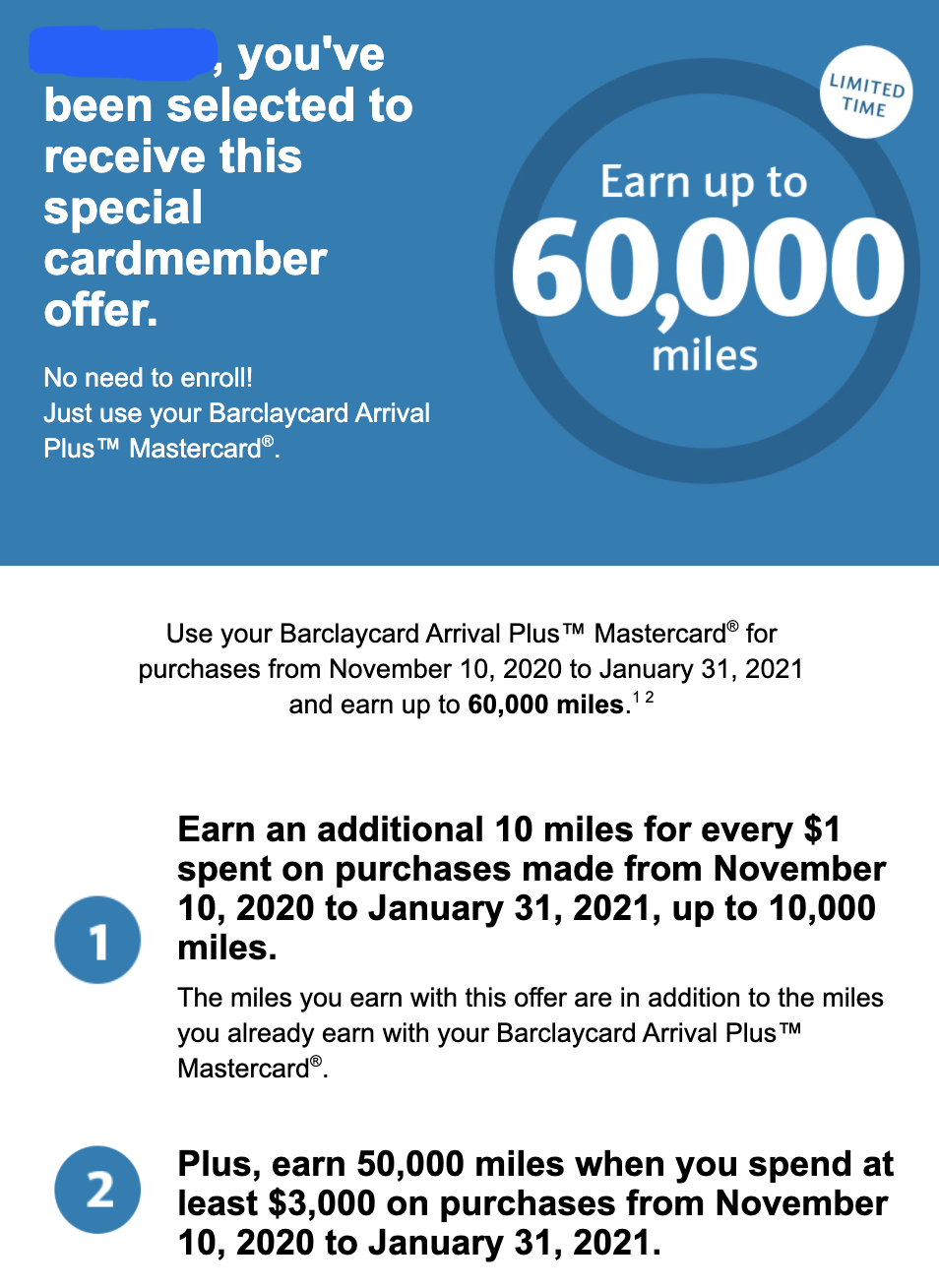

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card. Barclays has increased the signup bonuses for its two JetBlue World Elite MasterCards (WEMC) to 100,000 points each:

Following Citi's drastic devaluation of credit card protection benefits, Barclays has also cut quite a few protection benefits on its credit card portfolio effective November 1, 2019. The following benefits are removed from most of their credit cards:

At the same time, just like other MasterCard issuers, Barclays has added Cellphone Protection to its World MasterCard and World Elite MasterCard. So after the devaluation, Barclays American Airlines Aviator Red Word Elite MasterCard, for example, will offer protection benefits such as Travel Accident Insurance, Travel Cancellation and Interruption, Baggage Delay, Cellphone Protection, Identity Theft, Rental Car Collision Damage Waiver (still secondary), etc. For details of credit card protection benefits, please visit our Protection page. Overall, the changes are not as bad as Citi's but still very bad for Barclays' cardholders. BTW, American Express also has some major benefit changes on the way (kicking in as of 1/1/2020), which we will cover in the next post. It seems like a trend in the industry, but we will see if other major players such as Chase, Bank of America, Wells Fargo, and US Bank will follow suit. There are some recent updates as the following and we are also working on updating several other card reviews.

These are the recently updated signup offers:

Barclays Arrival Plus increases signup bonus to 70,000 miles with the first annual fee waiver11/19/2018 It seems like every card issuer is upping the signup bonuses to attract new applicants towards the end of the year. Barclays has just increased signup bonus on its popular Arrival Plus WEMC from 60,000 miles to 70,000 miles while waiving the first year annual fee. These miles are not and can not be transferred to frequent flyer miles, unlike those miles earned from Arrival Premier WEMC; instead, they can be redeemed to cover any travel expense at least $100 at 1 cent per mile and you also receive 5% of the redeemed miles back each time. In this way, the signup bonus is worth $735 in travel. This is very similar to Capital One Venture Card's 75K offer.

|

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed