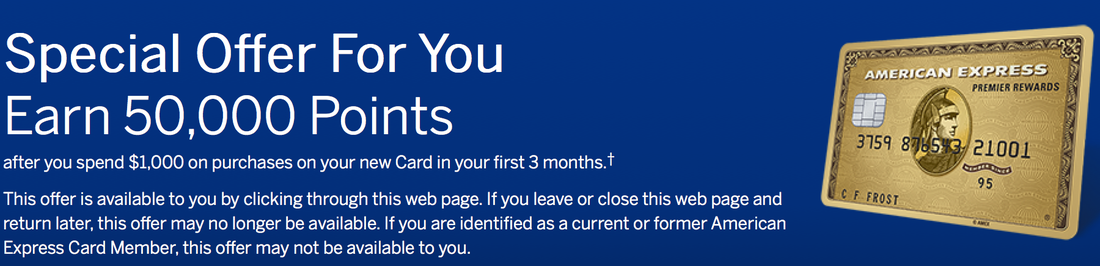

However, there is no public link that works for everyone. Amex has recently been trying something new when offering a signup promotion to customers. Looks like that people may get different offers when visiting Amex website. Don’t worry, if you follow the following steps, you will most likely get the 50K offer on the PR Gold:

- open your browser in incognito mode (in Google Chrome, or InPrivate mode in Internet Explorer, or Private mode in Firefox or Safari);

- visit Amex website and find the Premier Rewards Gold Card - most likely you will see the 50K offer;

- if you still have the 25K offer showing, clear cookies in your browser and try again or use a different browser.

Also for a limited time, Amex is also running a promotion offer for its Platinum Card - you will receive 100,000 Membership Rewards points after you open a new account and spend $3,000 within 3 months. The regular offer is 40,000 points. The $450 annual fee is NOT waived. Steep the annual fee may seem, after taking advantage of the $200 annual airline credit, your effective annual fee becomes $250 and you could enjoy some very valuable perks such as airport lounge access, Fine Hotels and Resorts, reimbursed Global Entry application fees, etc. That is why it is not only on our Top List, but also recommended as one of cards worth paying annual fees without spending. Please note that the signup bonus will NOT be given if you have or had this product.

You can follow similar steps listed above; however, the 100K offer on the Platinum Card is much harder to come by - you may need to try dozens of times. If you prefer calling Amex instead, you can give them the POID code BUIU:0001 and they will be able to find the 100K offer for you.

© 2015 DrCreditCard.net All rights reserved.

RSS Feed

RSS Feed