- Citi Premier has seen the best signup bonus ever - 80,000 ThankYou points with a $95 annual fee (our value $1,105).

- Citi Prestige has been pulled from Citi website and is discontinued to new applications until further notice. There are two possibilities: one is that it will be gone for ever as Citi might exit the fierce high-end card market, and the other is that Citi might be working on a major revamp and will bring it back at some point in the future. We might have to pull it from our Top 10 list pending further confirmation.

- Chase IHG Premier WEMC also offers the best ever - 150,000 IHG Rewards points with the 1st annual fee waiver (our value $600).

- Barclays Wyndham Visa cards also hit historical high: 60,000 Wyndham Rewards points on earner Visa, 90,000 points on either earner+ Visa or earner Business Visa. Our valuation for these three offers are $470~$625.

|

0 Comments

Throughout this pandemic when many card issuers have been bringing temporary benefits or bonuses to keep their existing cardmembers, Barclays has been quiet, until now.

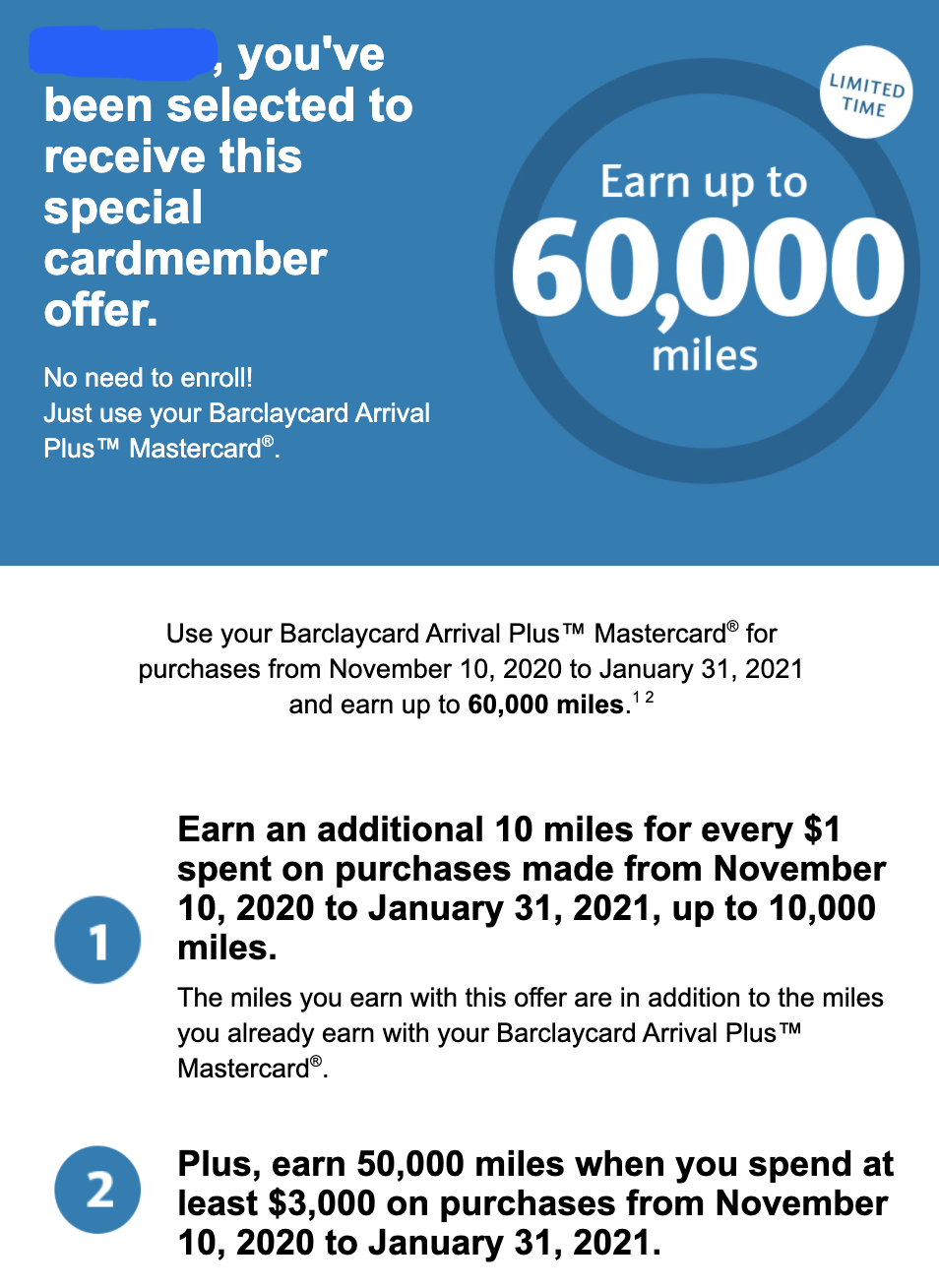

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card. We have been continuing to make updates throughout the site. Here we would like to highlight a few important ones:

In addition, you may find the following news interesting.

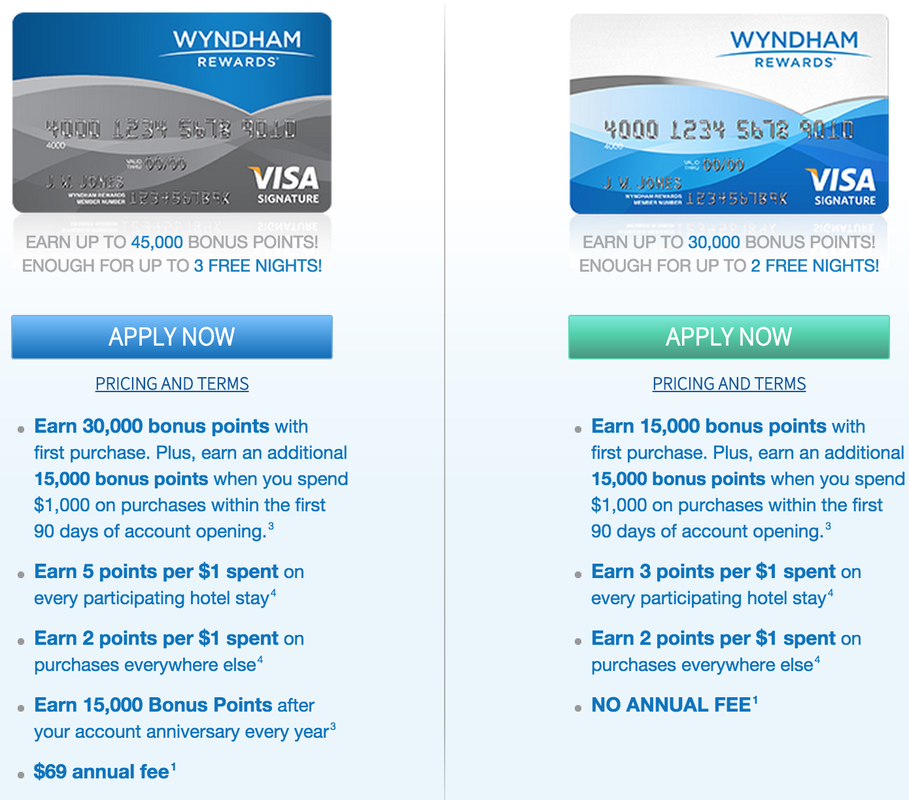

© 2016 DrCreditCard.net All rights reserved. Wyndham Rewards just a revolutionary revamp of its program earlier this month - it used to require 5,500 to 50,000 points per night across its 9 tiers of hotels, but effective May 11, 2015, each hotel will require the same 15,000 points per night. This is the most interesting change among hotel royalty programs in the recent years, because it is against the normal "add a new category/tier and require more points" type of devaluation we have witnessed. Obviously it will be a bad deal if you want to redeem points for lower end hotels, but it dramatically increases the value for high end hotel redemptions. In our book, the value of Wyndham Rewards points actually double, increasing from 0.4 to 0.8 cent per point! Barclays Wyndham Rewards Visa Signature that returns 2x points for general spending will be equivalent to 1.6% cashback.

What is more exciting is that Barclays and Wyndham have increased signup bonus for both versions of the Visa Signature cards.

We will recommend signing up the $69 version, because you will receive 3 free nights instead of 2 free nights upon signup, and the annual free night (15,000 points) is totally worth the $69 annual fee. Landing page for both offers (May 21, 2015) |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed