- BofA Alaska Airlines Visa received a revamp with a historical best offer of 70,000 miles + $99 companion pass.

- Delta introduced a new perk for all its cobranded cards (Delta Gold Amex, Delta Platinum Amex, Delta Reserve Amex): 15% off miles for awards travel on Delta flights.

- Amex elevated signup bonuses on all the Hilton cobranded cards: 100,000 points for Hilton Amex, 150,000 points for Hilton Surpass, and 165,000 points for Hilton Business Amex.

- Capital One rebranded Spark Travel Elite as Venture X Business Card, which shares almost all the features as the personal Venture X Card.

- Chase Aeroplan Visa saw another 100,000 miles offer, but with a high $20K spending requirement.

|

Not that many exciting new signup promotions recently, but we still keep making updates throughout the site. Here is a summary of some important updates.

0 Comments

Our featured review is aimed to summarize the temporary credit card benefits during the COVID-19 pandemic and we have some new updates. The entire post is copied below with the current offers highlighted in cardinal.

Updated May 16, 2021. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. Note that while some benefits are applied automatically, some benefits require activation through a link or via online account. The current offers are highlighted in cardinal. American Express

Bank of America

Barclays

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2021 DrCreditCard.net All rights reserved. There have been more temporary credit card benefits announced recently, mostly on Amex cards. Via Amex Offers, Amex introduced $10-$20 monthly dining credits for a few personal co-branded cards and $10-20 monthly wireless credits for a few business co-branded cards. In addition, on personal Marriott and Hilton cobranded cards, there are some bonus points opportunities for general spendings. We have updated the featured review accordingly and also pasted everything over here. As always, the new benefits are highlighted in cardinal.

Updated February 15, 2021 COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. Note that while some benefits are applied automatically, some benefits require activation through a link or via online account. American Express

Bank of America

Barclays

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2021 DrCreditCard.net All rights reserved. There are some recent updates for our featured review, mostly for Chase Sapphire Reserve, Sapphire Preferred, Ink Preferred, Freedom Unlimited, Freedom Flex. We copy the content of the review below and highlight the updates in cardinal.

Updated October 22, 2020. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. American Express

Bank of America

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2020 DrCreditCard.net All rights reserved. BofA Alaska Visa has offered the best historical bonuses for both the personal version and business version:

We are continuing updating the featured review and also posting in the blog section. The new updates are highlighted in cardinal below: Delta Gold Amex (personal & business) gets 4x miles on dining & 5x on Delta purchases; Delta Platinum Amex and Delta Reserve Amex (personal & business) get 5x miles on Delta and 500 miles + 500 MQMs per $1K spent, up to 25K bonus miles. In addition, we rearranged quite bit of other parts of the write-up to make it easier to navigate. We also added annual free night extension by Hilton, Marriott, Hyatt, and IHG.

Updated August 17, 2020. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. American Express

Bank of America

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2020 DrCreditCard.net All rights reserved. We will regularly update this review and also post in the blog section.

Updated August 5, 2020: Amex Marriott cobranded cardmembers will earn 10x points on Marriott & gas & dining through 10/31/2020 via Amex Offers. See details highlighted in cardinal below. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. American Express

Bank of America

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2020 DrCreditCard.net All rights reserved. The summary of all the temporary credit card benefits during this pandemic (updated 7/30/2020)7/30/2020 The featured review can be found here.

Updated July 30, 2020. Please note that the new updates are highlighted in cardinal: select Chase cardmembers receive 5x or 7x miles/points on groceries and gas, up to $1,500 in purchase per month, between 8/1/2020 and 9/30/2020. This offer requires activation. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. American Express

Bank of America

Capital One

Chase

Citi

HSBC

U.S. Bank

© 2011-2020 DrCreditCard.net All rights reserved. As card issuers are bringing more and more temporary benefits to their credit card products during this pandemic, we have decided to write a featured review "Temporary Credit Card Benefits During the COVID-19 Pandemic" and will update it as there is new information available. Below is the current write-up:

Updated July 16, 2020. COVID-19 has obviously changed consumer behavior in a way that most of us probably would had never anticipated before, and it only makes sense that credit card issuers have been making adjustments accordingly. This review summarizes all the temporary benefits provided by credit card issuers during this pandemic. American Express

Bank of America

Capital One

Chase

Citi

HSBC

U.S. Bank

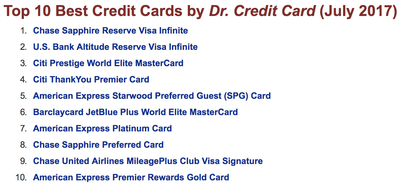

© 2011-2020 DrCreditCard.net All rights reserved. Alliant Credit Union Visa Signature, which carries a $59 annual fee and offers unlimited 3% cashback for the first year and 2.5% cashback thereafter, was introduced earlier this year, but I haven't got a chance to write the review and crunch the numbers until recently. After Year 1, you need to spend $11,800 a year on this card to beat a 2% cashback card with no annual fees, such as Alliant Visa Platinum Rewards, Citi Double Cash, or Fidelity Visa, as $11,800 x (2.5 - 2)% = $59. If your have large annual spendings, this card is hugely lucrative - for example, if your annual spending is $100K, you will earn an additional $440 over a 2% card after considering the $59 annual fee. After I put this card through our analysis considering all four "P" factors, this card becomes the #2 Best Credit Card for Rewards and #9 Best Credit Card by Dr. Credit Card. Even though we are sad to see one of our longtime favorite Amex Premier Rewards Gold dropping out of the Top 10 list, the more competition the better for the consumers. If you ever wonder if Alliant Visa Signature is the best cashback card out there when you spend at least $12K a year, there are a few options you may want to look into:

The bottom line: for most consumers, Alliant Visa Signature is the "King of Cashback". We could only hope that it won't be dramatically changed in the near future. Of course, we have been making other updates throughout the site. For example, early this week Amex has again brought back limited time offers for the four Delta SkyMiles Amex Cards: personal and business Gold (60K miles + $50), personal and business Platinum (70K miles + 10K MQMs + $100). © 2017 DrCreditCard.net All rights reserved. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed