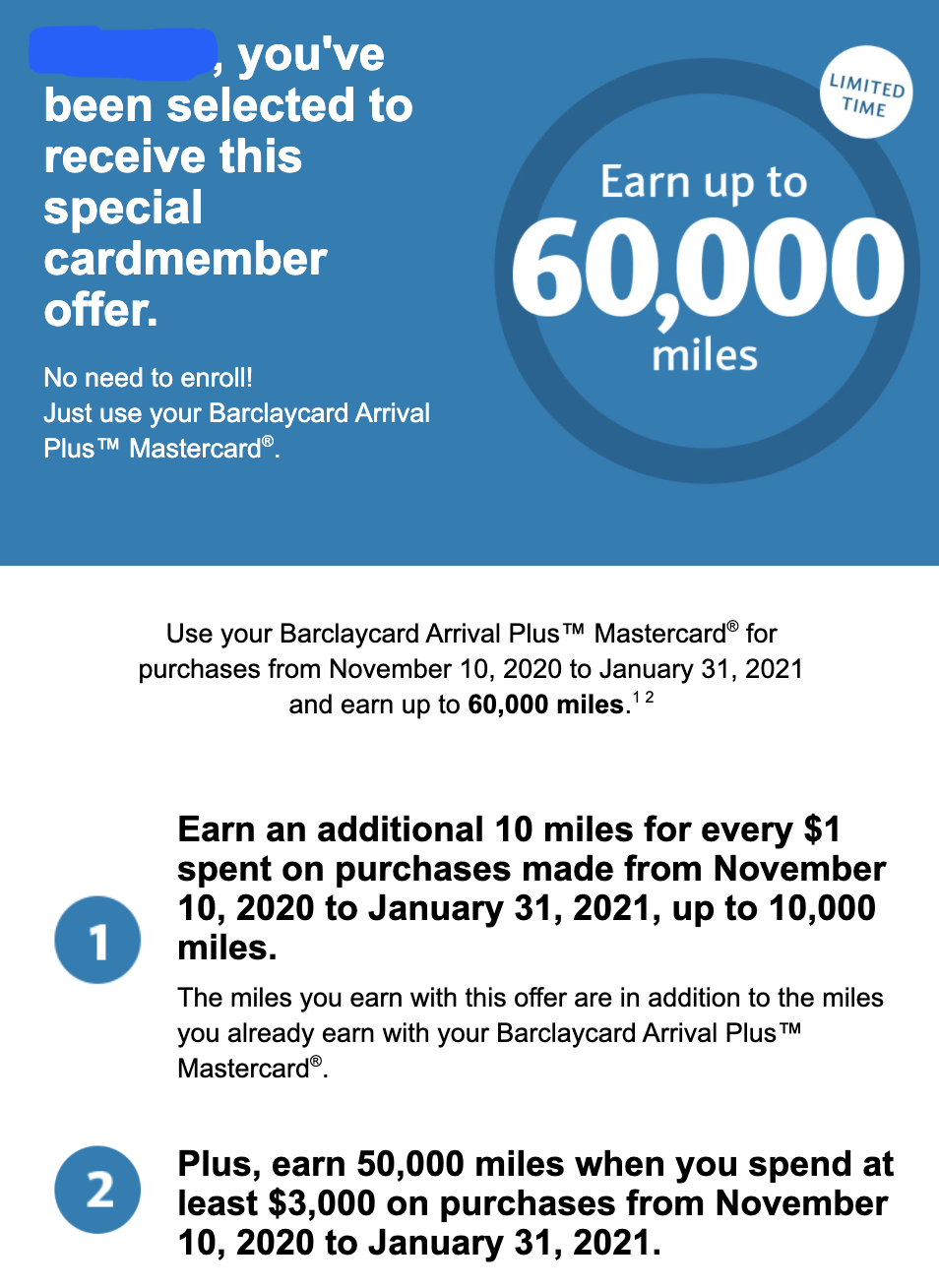

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card.

|

Throughout this pandemic when many card issuers have been bringing temporary benefits or bonuses to keep their existing cardmembers, Barclays has been quiet, until now.

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card.

0 Comments

Barclays has increased the signup bonuses for its two JetBlue World Elite MasterCards (WEMC) to 100,000 points each:

Chase just brought us an improved signup bonus for Sapphire Preferred:

These are the recently updated signup offers:

The best ever Southwest Companion Pass deal & JetBlue Plus WEMC 60K points (our value $830)11/11/2017 You have probably noticed that I have stopped doing the regular (or irregular) update posts in the blog section. But it doesn't mean that I have stopped updating the website. The reason for giving up on the round-up type of blog posts is that I am getting tired of it - they are too dry to me and probably to most of you. If you remember, in a post written in March 2016 "Five Years of Earning and Redeeming Miles/Points with Credit Cards - My Personal Story" I had a plan for more interesting posts such as trip reviews and personal stories; unfortunately that plan never took off - I probably only wrote one or two posts like that. The reason is that I simply don't have time - I have a full-time demanding job, a 2 to 3-hour daily commute, and two young kids that need a lot of attention. I can't and don't want to compete with those bloggers that write several posts per day; however, I think my website has some unique features that are not available on any other websites or blogs. So I have decided to focus more on the website (and reviews) than the blog posts: no more round-up type of posts, and I will only write blog posts whenever I feel that I need to share my thoughts on something that is going on; on the other hand, I will continue to update the website and reviews, and it shall be pretty easy for you to know when a review was last updated.

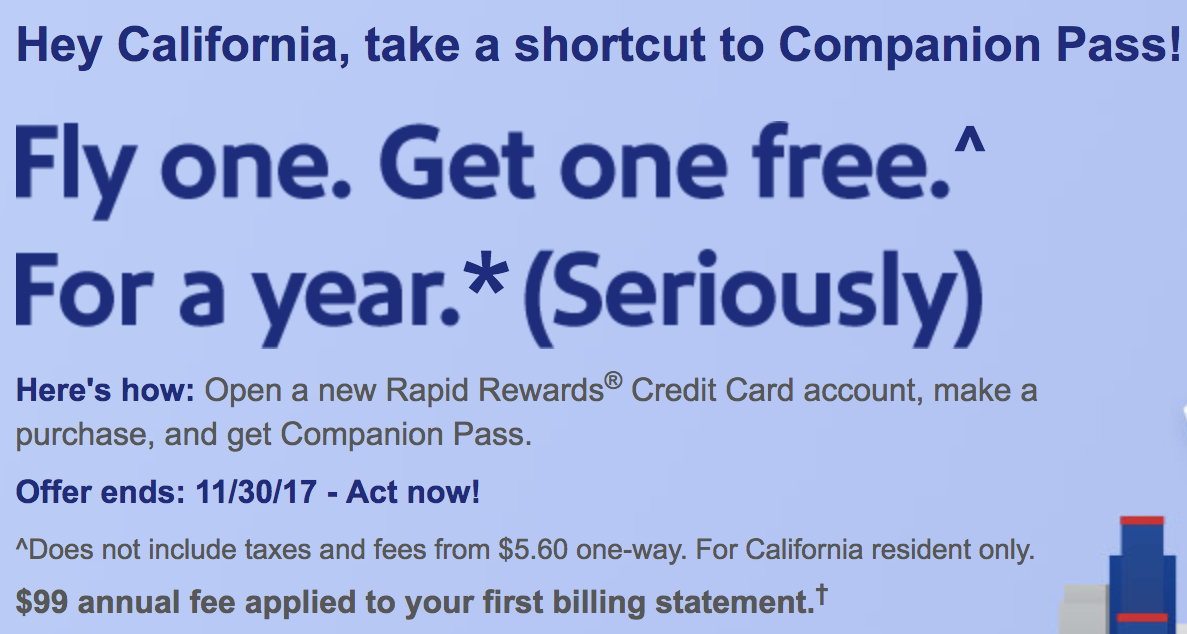

Today I would like to share two interesting deals. Southwest Companion Pass Deal for CA Residents Chase Southwest Personal Premier or Plus Visa has a deal that never happened before: for California residents only, when you open a new credit card account and make just one purchase, you will receive Companion Pass status through December 2018; in addition, you will receive 40,000 points after spending at least $1,000 within the first 3 months of account opening. Even though the 40K is lower than the 50-60K offers that haven't been hard to find over the last years, the Companion Pass offer is almost too good to be true. Companion Pass allows you to take a companion for free as many times as you want (almost free - you are only paying taxes and charges for the companion) as long as you maintain this status; it normally requires earning 120K points in a calendar year. In the past, a relatively easy way to earn this status to to sign up two Chase Southwest Visa Cards, each giving you 50-60K, and if you do this early in a calendar year, you will have this status for the rest of that year and for the entire following calendar year. So with this offer, you only need to sign up one single card! CA residents, hurry up as this offer expires November 30, 2017. Barclaycard JetBlue Plus WEMC 60K Barclaycard JetBlue Plus WEMC now has an excellent offer of 60,000 points after spending $1,000 within 3 months of new account opening, increased from the regular 30K. JetBlue points are different from traditional miles - they are somehow closely based on the revenue price of the tickets. Our value is 1.4 cents per point (the range could be between 1.1 to 1.9 cents). However, JetBlue Plus WEMC has a built-in feature: whenever you redeem points for awards, you will receive a rebate of 10% points back to your account, which essentially increases our value of JetBlue points to 1.55 cents. Note that the $99 annual is not waived, so the signup bonus of 60K will be valued at $830 in our book. Note that JetBlue is also running a limited time promotion: when you redeem points for awards by 11/14/17 and fly by 2/14/18, you will receive a rebate of 15% points back to your account. Of course, not every JetBlue member can or/and wants to take this promotion, but if you do and you have a JetBlue Plus WEMC, you will receive a 25% rebate in total, which increases the value of these points to 1.87 cents a piece. For members that are interested in signing up a new JetBlue Plus WEMC now, this promotion is almost irrelevant as the time is running out too soon, but for members that already had a JetBlue Plus WEMC, this promotion is definitely worth checking into. © 2017 DrCreditCard.net All rights reserved. We have been making updates throughout the site and this post highlights some of them plus some recent news.

© 2017 DrCreditCard.net All rights reserved. We have been continuing to make updates throughout the site. Here we would like to highlight a few important ones:

In addition, you may find the following news interesting.

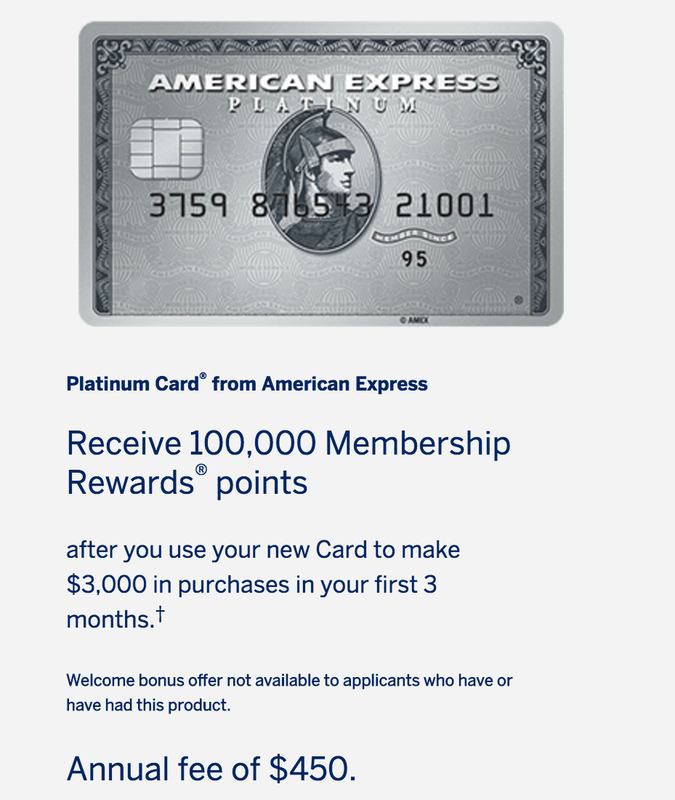

© 2016 DrCreditCard.net All rights reserved. This is the best signup offer so far this year - our value is $1,250!

American Express Platinum Card has always been one of the best cards for perks and protection. The regular signup bonus is 40,000 points, and through this special offer, you will receive 100,000 points after spending $3,000 within 3 months of new account opening, if you don't have or have never had this product before. Our current value for Membership Rewards points is 1.5 cents a piece, and the card comes with a $450 annual fee which is not waived for the first year. However, you may receive up to $200 annual airline incidental credit. So our valuation for this signup bonus is 100,000 points x 1.5 cents/point - $450 +$200 = $1,250. That is why this offer is currently listed as #1 on the best promotions page. Application Landing Page Weekly Review (April 29, 2016) - JetBlue Plus Card made to our Top 10 Best Credit Cards List, etc.4/29/2016 This week, we have three new reviews going online: Barclays Luxury Card MasterCards (Titanium, Black, and Gold), Barclays Miles & More MasterCard (Lufthansa etc.), and Barclays JetBlue MasterCards (non-annual fee version, JetBlue Plus, JetBlue Rewards, JetBlue Business).

JetBlue Plus World Elite MasterCard is a new product introduced earlier this year and wasn't included in our original analysis to produce the Top 10 Best Credit Cards by Dr. Credit Card list that was published the first time earlier this month. After a thorough analysis, we were pretty surprised that JetBlue Plus Card takes home the #3 spot in the rewards category and is rated #4 overall. That is an amazing feat. Let's see why. Unlike legacy airlines, JetBlue has a revenue based frequent flyer program, and its TrueBlue points can be redeemed for JetBlue flights at an almost fixed-value rate of around 1.4 cents per point. Here you won't get an exciting redemption like an international long haul business/first class award, but you also avoid a lot of hassles trying to find an available seat and maximize points value, as TrueBlue points are very straightforward. JetBlue Plus Card has a unique feature that returns 10% points each time you redeem for JetBlue flights, essentially increasing the value of TrueBlue points to 1.55 cents a piece. In addition, JetBlue Plus offers a very competitive 6-2-1 earning structure for JetBlue, dining & groceries, and other purchases (9.3%, 3.1%, and 1.55% respectively) and several valuable perks that easily justify the annual fee, including 5,000 anniversary bonus points, first bags free, and a potential Mosaic status after $50K annual spending. Our biggest concern is that we are not sure if JetBlue will suddenly devaluate its points, as we have seen in many times in the airline/hotel industry. That is exactly the reason why we always recommend miles/points cards with transfer partners over those affiliated with a certain airline or hotel chain, as the former is much more devaluation proof than the latter. For now, however, this card makes a lot of sense for JetBlue flyers, considering its good signup bonus, amazing rewards and travel perks, and decent protection. © 2016 DrCreditCard.net All rights reserved. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed