- Amex Hilton (no annual fee): 70,000 points + one free night (the best ever and the same as in 2022)

- Amex Hilton Surpass ($95): 130,000 points + one free night (the best ever and the same as in 2022)

- Amex Hilton Business ($95): 150,000 points + one free night (the best ever and better than anything before)

- Amex Hilton Aspire ($450): 150,000 points + one free night (regular offer but still the best ever)

|

All Amex Hilton cobranded credit cards are offering points + one free night, the best ever we have seen.

0 Comments

Chase has brought back the 80,000 Ultimate Rewards points offer for its popular Sapphire Preferred ($95 annual fee): spend $4,000 within the first 3 months of new account opening and receive 80,000 points ($1,200 in travel through Chase or 80,000 miles of United, Singapore, British, Flying Blue, Southwest, JetBlue, Hyatt, etc.)

If you are willing to go to a Chase branch to apply through a banker and spend an additional $2,000 within 6 months, you will get a slightly better deal of 90,000 points. Citi has just brought back the best signup bonus for the cobranded American Airlines AAdvatange WEMC: receive 75,000 miles after spending $3,500 within 4 months of new account opening.

Citi also has a great 75,000 points offer for Citi Premier WEMC: receive 75,000 points after spending $4,000 within 3 months of new account opening. This is slightly lower than the historical high of 80,000 points offered last year. Citi has also updated its rule on signup bonus for all its products to "the bonus won't be available if you have received a new account bonus on this card in the past 48 months". Previously Cit has a 24-month rule that disallows bonus when you opened or closed any of the cards in the same "family" in the past 24 months. For example, several AAdvantage personal cards are considered a family, and several cards earning ThankYou points are considered a family. The new rule is less restrictive in terms of card family but obviously more restrictive in terms of time intervals between bonuses. Not that many exciting new signup promotions recently, but we still keep making updates throughout the site. Here is a summary of some important updates.

Chase has brought the best signup bonuses ever for its two no-annual-fee business cards Ink Cash and Ink Unlimited: 90,000 Ultimate Rewards (UR) points (advertised as $900 cash) with a lower spending requirement of $6,000 within 3 months. If you don't have a premium UR card, 90,000 points' best value will just be $900 in cash; however, if you have a premier UR card such as Ink Preferred and Sapphire Preferred, the points earned on Ink Cash/Unlimited can be transferred into the premier UR account and thus eligible for the frequent traveler miles/points transfer feature which in our book elevates UR points to 1.5 cents per point, and in this way, 90,000 points will be worth about $1,350. Thus, these are arguably also the best UR points bonuses among all current Chase UR cards: Ink Preferred ($95) offers 100,000 points with a tough $15,000 spending requirement; Ink Premier ($195) offers 100,000 points with a $10,000 spending requirement and their points cannot be transferred to any other Chase UR card, capping the maximum value to be $1,000; Sapphire Reserve offers 80,000 points but the annual fee is $550 (effectively $250 considering the annual $300 travel credit).

Citi has brought back the best signup offers ever for two of its popular personal cards:

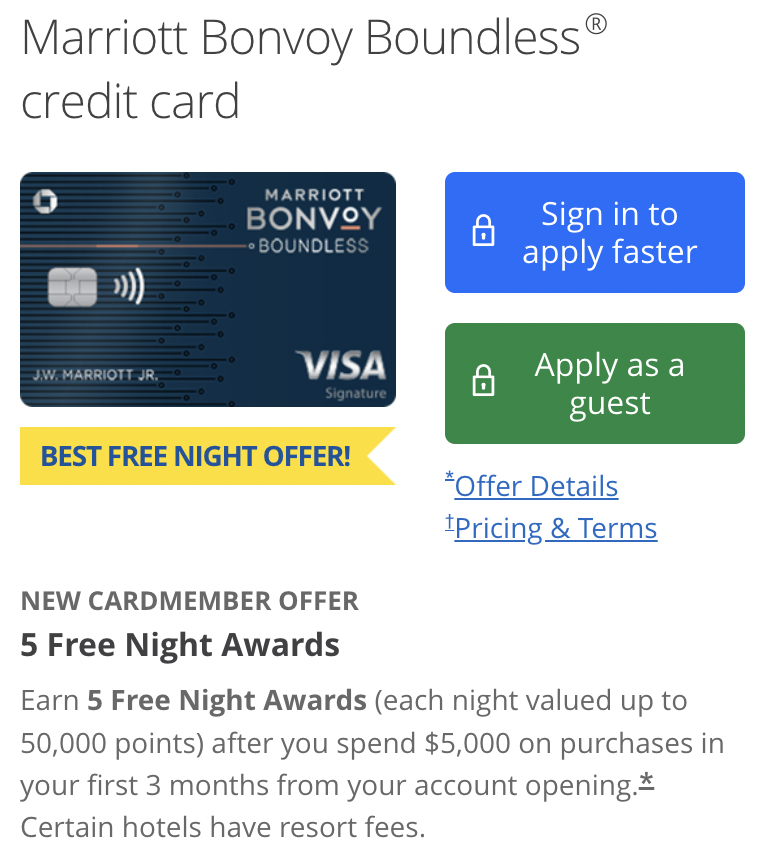

Chase has increased signup bonus for Sapphire Reserve from 50,000 to 60,000 points, while cutting it down for Sapphire Preferred from 80,000 to 60,000 points. There are also various other changes in our Promotion page. It is a good thing that Chase has brought back the best offer for its Marriott Bonvoy Boundless Visa after two years. You will receive five free nights at Marriott portfolio hotels, each with a redemption level up to 50,000 points, after you spend $5,000 within 3 months of new account opening. The free night e-certificate expires 12 months after issuance; you might also top off the free night certificate with your own Marriott points, up to 15,000 additional points for a higher redemption level. We value each of the free night certifications close to 50K Marriott points (for hotel redemptions only): $300 for each certificate, valued at 0.6 cents per point, because the flexibility of topping off free nights. The signup bonus minus annual fee is worth $1,450 in our book!

Chase Aeroplan World Elite MasterCard is now rated #3 Best Credit Card by Dr. Credit Card. As you may use Aeroplan points on Air Canada or its partner airlines (Star Alliance) including United Airlines, it could be a good card for U.S. consumers for travel awards within U.S. and worldwide.

|

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed