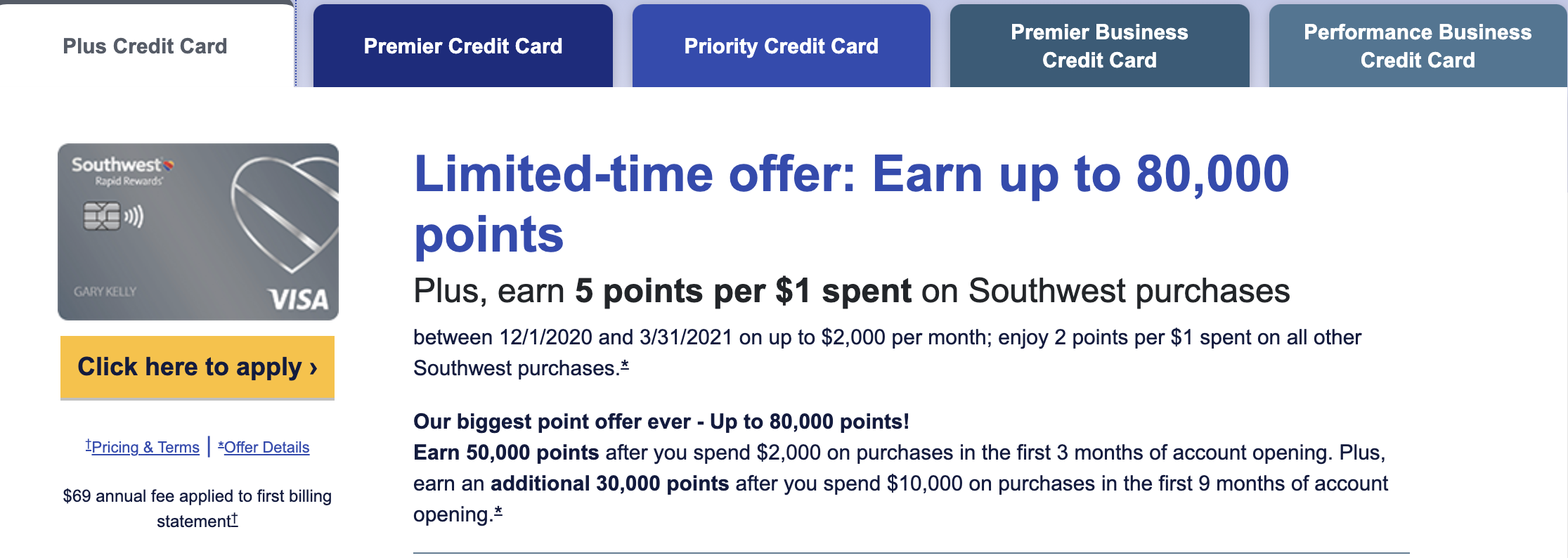

- Chase Southwest RR Plus Visa ($69 annual fee): up to 80,000 points (50,000 points after you spend $2,000 within 3 months of new account opening, and additional 30,000 points after you spend a total of $10,000 within 9 months of new account opening, a total of $990 travel rewards in our book).

- Chase Southwest RR Premier Visa ($99 annual fee): up to 80,000 points (50,000 points after you spend $2,000 within 3 months of new account opening, and additional 30,000 points after you spend a total of $10,000 within 9 months of new account opening, a total of $960 travel rewards in our book).

- Chase Southwest RR Priority Visa ($149 annual fee): up to 80,000 points (50,000 points after you spend $2,000 within 3 months of new account opening, and additional 30,000 points after you spend a total of $10,000 within 9 months of new account opening, a total of $910 travel rewards in our book).

In addition, the two Chase Southwest BUSINESS Visa cards continue to offer great signup bonuses as well:

- Chase Southwest RR Premier BUSINESS Visa ($99 annual fee): 60,000 points after you spend $2,000 within 3 months of new account opening, a total of $740 travel rewards in our book).

- Chase Southwest RR Performance BUSINESS Visa ($199 annual fee): up to 100,000 points (70,000 points after you spend $5,000 within 3 months of new account opening, and additional 30,000 points after you spend a total of $25,000 within 9 months of new account opening, a total of $1,050 travel rewards in our book). The $25K spending requirement is on the high side, but once you hit $25K spending, you will earn at least 125,000 points which are more than enough to earn you Southwest Companion Pass, which normally requires earning 125,000 points or flying 100 one-way flights in a calendar year and allows you to take a companion for free (you pay for your own ticket and the taxes and fees for your companion) as many times as you could for the rest of the calendar year and the entire next calendar year. Signing up this card remains obviously the easiest way to qualify for this lucrative status.

As usual, the signup bonus is not available if you currently have any personal Southwest Rapid Rewards credit card or have received a signup bonus for any personal Southwest credit card in the past 24 months, except for Southwest Premier Business card (for which the bonus is not available if you current have this business card or have received a signup bonus for this business card in the past 24 months). In addition, the three personal cards are subject to Chase 5/24 rule based on anecdotal reports (you won't be approved for the card if you have opened 5 or more new accounts within the past 24 months; any new account with any issuer will count, not just with Chase; new accounts include most credit cards and charge cards but exclude non-Chase business cards and store charge cards).

RSS Feed

RSS Feed