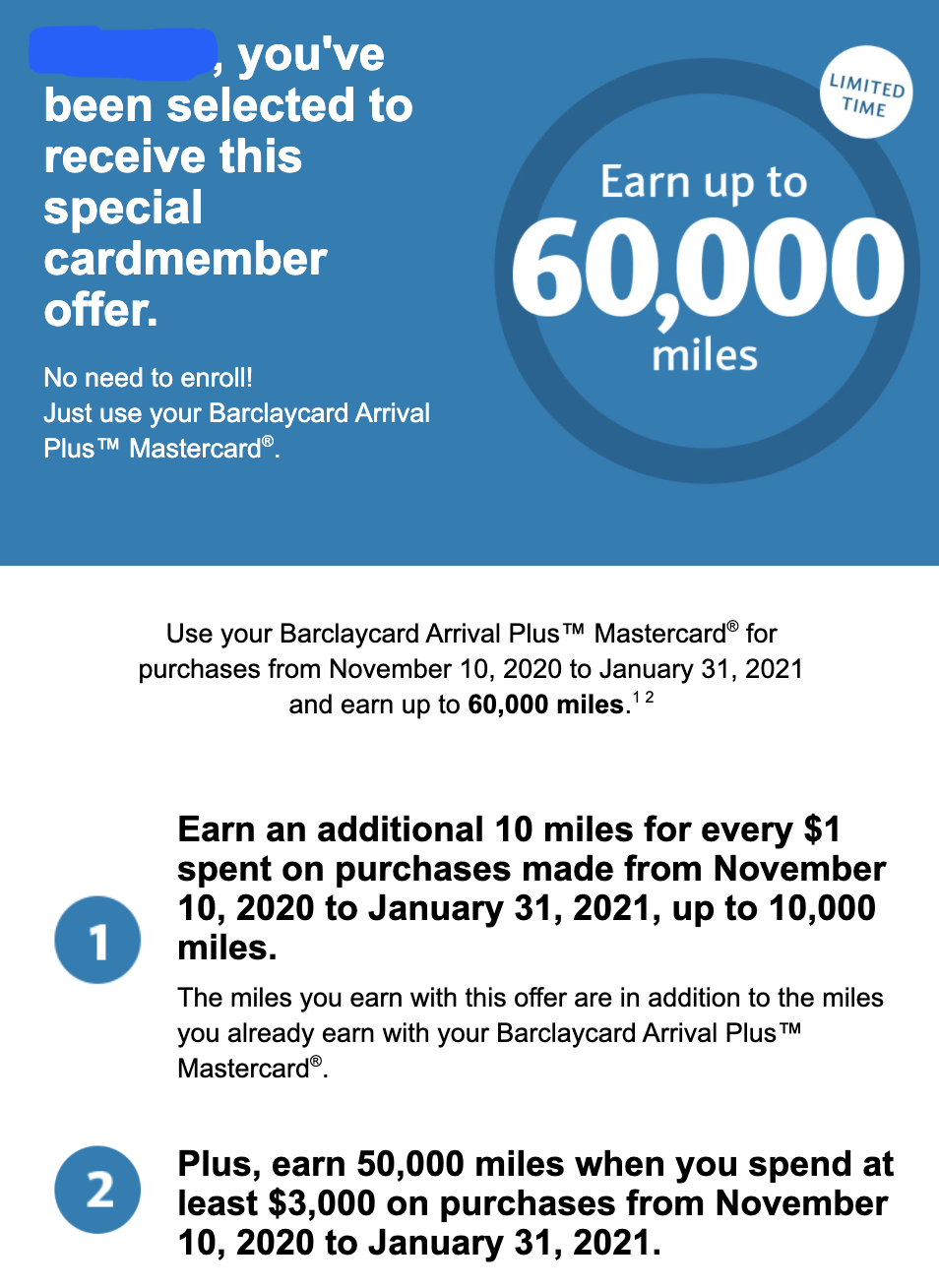

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card.

|

Throughout this pandemic when many card issuers have been bringing temporary benefits or bonuses to keep their existing cardmembers, Barclays has been quiet, until now.

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card.

0 Comments

There are some recent updates as the following and we are also working on updating several other card reviews.

Amex EveryDay Preferred has been one of our favorite cards since its launch in March 2014. Our major complaint about this card is its relatively modest signup bonus of 15,000 points, especially compared to the great offering from other cards. Now for a limited time, Amex has doubled the signup bonus: you will receive 30,000 Membership Rewards points, which can be transferred to miles of British, Delta, Hawaiian, Air Canada, ANA, Singapore, Cathay Pacific, etc, after you spend $2,000 within 3 months of new account opening. Note that the $95 annual fee is NOT waived for the first year as always.

Amex has recently been trying something new when offering a signup promotion to customers. Looks like that people may get different offers when visiting Amex website. If you follow the following steps, you will most likely get the 30K offer on EveryDay Preferred:

© 2015 DrCreditCard.net All rights reserved. Amex has been running 75K signup promotions for its Business Gold Rewards Card, one of our Top Listers, for a long time and they have always been limited time offers (sometimes lasted only one day). Earlier this year, Amex has been keeping a link for a similar offer for widely targeted customers. You will need to visit the link below and log into your Amex account to see if you qualify for 75,000 points. If you receive an error then you probably don't qualify. You will need to spend $5,000 within 3 months of new account opening to receive 75,000 Membership Rewards points, which can be transferred to miles/points of Delta, Hawaiian, Air Canada, British, Singapore, Cathay Pacific, ANA, and many other airline or hotel partners. As always, the $175 annual fee is waived for the first year.

Landing Page © 2015 DrCreditCard.net All rights reserved. Amex has a promotional offer for one of our Top Listers Premier Rewards Gold Card - you will receive 50,000 Membership Rewards points after you open a new account and spend $1,000 within 3 months. The regular offer is 25,000 points. The first year annual fee is waived, saving $195. Please note that the signup bonus will NOT be given if you have or previously had this product.

However, there is no public link that works for everyone. Amex has recently been trying something new when offering a signup promotion to customers. Looks like that people may get different offers when visiting Amex website. Don’t worry, if you follow the following steps, you will most likely get the 50K offer on the PR Gold:

Also for a limited time, Amex is also running a promotion offer for its Platinum Card - you will receive 100,000 Membership Rewards points after you open a new account and spend $3,000 within 3 months. The regular offer is 40,000 points. The $450 annual fee is NOT waived. Steep the annual fee may seem, after taking advantage of the $200 annual airline credit, your effective annual fee becomes $250 and you could enjoy some very valuable perks such as airport lounge access, Fine Hotels and Resorts, reimbursed Global Entry application fees, etc. That is why it is not only on our Top List, but also recommended as one of cards worth paying annual fees without spending. Please note that the signup bonus will NOT be given if you have or had this product. You can follow similar steps listed above; however, the 100K offer on the Platinum Card is much harder to come by - you may need to try dozens of times. If you prefer calling Amex instead, you can give them the POID code BUIU:0001 and they will be able to find the 100K offer for you. © 2015 DrCreditCard.net All rights reserved. Amex Starwood Preferred Guest (SPG) 30,000 points each (personal and business) & 1st year free8/12/2015 Amex has offered increased signup bonus to 30,000 points (from the regular 25,000 points) for its Amex SPG, for several summers in a row. Now it is back through September 14, 2015. This time, you will need to spend $3,000 within 3 months to receive 30K points for the personal card version, and you will need to spend $5,000 within 3 months to receive 30K points for the business card version. Our current valuation of Starpoints is 2.25 cents per point, thus the signup bonus for each card will be $675. If you sign up both personal and business cards, you will receive 60,000 points.

Also note that even though the annual fee is waived for the first year, it has been increased from $65 to $95 effective today. However, Amex does bring a few new perks to justify the increase in annual fees: waived foreign transaction fees, complimentary unlimited Boingo Wi-Fi plan, complimentary premium internet at participating Starwood hotels, and finally access to Sheraton Club Lounges for business cardholders. We have updated our review to reflect these changes. Landing page for personal card Application page for personal card Landing Page for business card Application page for business card © 2015 DrCreditCard.net All rights reserved. We have three new reviews this week. Barclays replaced BofA as the new issuer of Hawaiian Airlines MasterCard, which has some improvements over the old product. BofA Spirit MasterCard returns 2-2.5 miles per dollar spent and looks great on paper, but we suggest you do your homework before jumping in. BofA's old Asiana Amex was very competitive with 2 miles per dollar spent earning rate and the new Asiana Amex after 2013 has been an disappointment due to the fact that BofA changed the earning rate on general spending to be 1 mile per dollar spent.

We also updated reviews on Amex Gold Delta and Platinum Delta cards due to the increased annual fee on Platinum Delta (from $150 to $195) and the added waived foreign transaction fees and EVM chip. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed