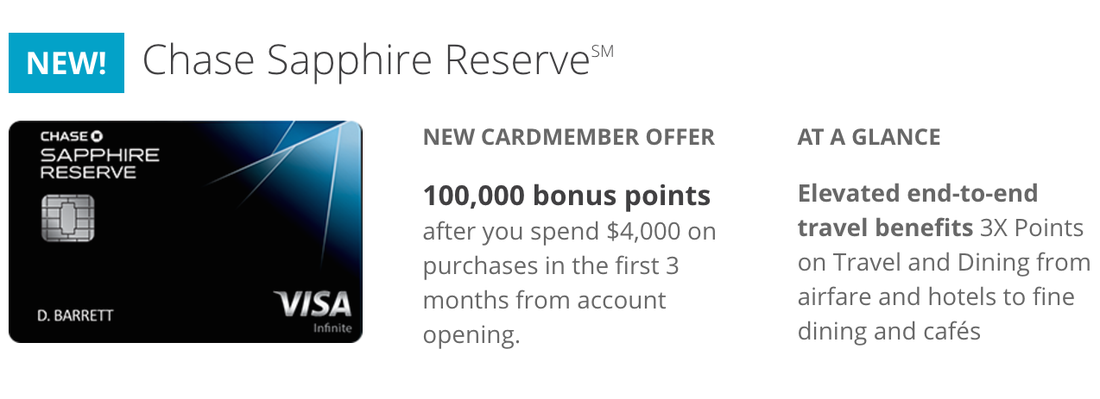

- 100,000 points after spending $4,000 within 3 months of new account opening.

- The annual fee is $450, but with the annual $300 travel credit that covers all expense in travel category (the industry first), it effectively becomes $150, a merely $55 more than Sapphire Preferred.

- 3x points on travel and dining - if you spend more than $3,667 per year in the bonus categories, you will beat the $55 difference in annual fees, and choosing the Reserve over Preferred is a no-brainer.

- Travel perks include Priority Pass Select for airport lounges, hotel privileges at Relais & Chateaux through Visa Infinite and at over 1,000 luxury hotels through Luxury Hotel & Resort Collection and Visa Signature Hotel Collection , Visa Infinite car rental privileges, Global Entry application credit, primary rental car collision coverage, and waived foreign transaction fees, etc.

- It offers the highest level of consumer and travel protection among all Chase cards.

Sapphire Reserve is now ranked #1 in signup bonus, #3 in rewards, #9 in perks, and #3 in protection, among all credit cards. By a large margin, it beats Citi Prestige to become the new #1 Best Credit Card by Dr. Credit Card! Let's look at side-by-side comparison of the old (left) and new (right) lists of Top 10 Best Credit Cards by Dr. Credit Card:

The last thing to know before applying Sapphire Reserve is that the so-called Chase 5/24 rule seems to be strictly enforced for online applications: if you have 5 or more new accounts opened and shown on your credit report in the past 24 months, including credit cards from all banks, possibly mortgages, loans, lines of credit, and even accounts as authorized users, you will get denied automatically by Chase. There are reports which indicated (1) applying in Chase branch when you pre-qualifies for the card or (2) applying as a Chase Private Client may bypass the 5/24 rule.

© 2016 DrCreditCard.net All rights reserved.

RSS Feed

RSS Feed