Barclays has just made a great card Barclays Arrival, which has been on our Top List, even better with several enhancements and a new name Arrival Plus World Elite MasterCard.

We never reviewed Wells Fargo credit cards before since we thought they were not as competitive or interesting as other products we review. However, in our first Wells Fargo review ever, we praised Wells Fargo for its great work for bringing us these two new cards - Propel 365 and Propel World Amex. Note that Propel World Amex also comes with an excellent 40,000 points offer when you open a new account and spend $3,000 within 3 months. The $175 annual fee is waived for the first year and you may also take advantage of the $100 airline incidental credit. Since it has been reported that you can redeem Wells Fargo Rewards points for airfare at 1.5 cents per point, the total signup bonus for the new Propel World is up to $700 ($600 for airfare plus $100 airline incidental)!

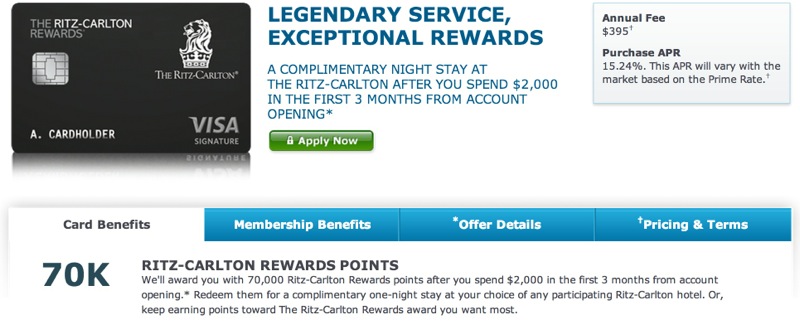

Landing Page for Propel World 40K offer

RSS Feed

RSS Feed