If you are willing to go to a Chase branch to apply through a banker and spend an additional $2,000 within 6 months, you will get a slightly better deal of 90,000 points.

|

Chase has brought back the 80,000 Ultimate Rewards points offer for its popular Sapphire Preferred ($95 annual fee): spend $4,000 within the first 3 months of new account opening and receive 80,000 points ($1,200 in travel through Chase or 80,000 miles of United, Singapore, British, Flying Blue, Southwest, JetBlue, Hyatt, etc.)

If you are willing to go to a Chase branch to apply through a banker and spend an additional $2,000 within 6 months, you will get a slightly better deal of 90,000 points.

0 Comments

Citi has brought back the best signup offers ever for two of its popular personal cards:

Chase has increased signup bonus for Sapphire Reserve from 50,000 to 60,000 points, while cutting it down for Sapphire Preferred from 80,000 to 60,000 points. There are also various other changes in our Promotion page. Chase Aeroplan World Elite MasterCard is now rated #3 Best Credit Card by Dr. Credit Card. As you may use Aeroplan points on Air Canada or its partner airlines (Star Alliance) including United Airlines, it could be a good card for U.S. consumers for travel awards within U.S. and worldwide.

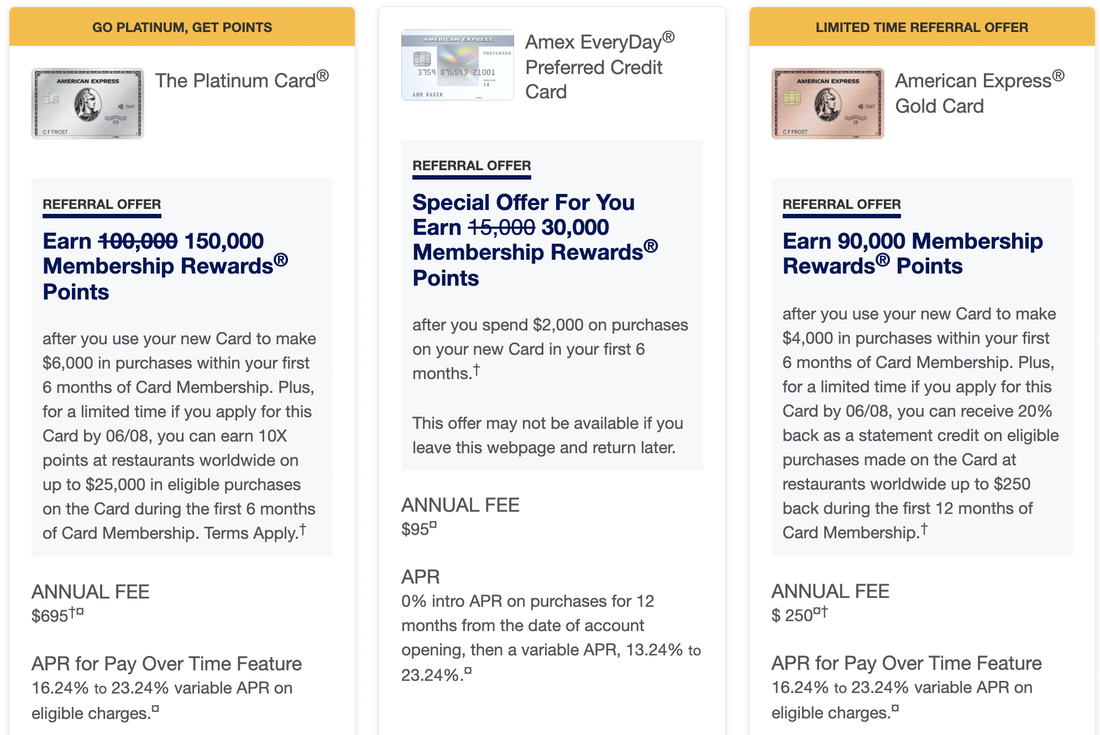

It appears that we have seen some best signup bonuses ever on the two very popular Amex charge cards. These offers are via referral links and now definitely better than the ones on Resy.com (Amex partner website), which again are much better than Amex's own website. Keep in mind that some of these referral links show different results based on your browser setting and sometime simply the time you visit - it is recommended to visit the links in the private browsing mode of your browser; sometimes, you might need to try multiple times to see them; sometimes, clearing caches/history in your browser helps too.

Amex has introduced some amazing signup offers for its Hilton Honors cobranded credit cards, arguably the best we have seen:

Chase has some amazing signup offers too. These offers give you Southwest Companion Pass status through 2/28/2023. Companion Pass is Southwest's potentially extremely lucrative top-tier elite status that allows you take a companion free of airline charges (not including taxes and government fees) on any Southwest operated flight as many times as you want and is normally achieved by flying 100 qualified one-way segments or earning 125,000 qualifying points in a calendar year.

Just a month after hugely improving its Miles program that allows frequent traveler miles/points transfer to 15 partners at 1:1 ratio, Capital One brought us its first ever high-end credit card - Venture X Visa Infinite Card, with the following impressive features:

Chase now has the best offer ever for its cobranded Southwest credit cards: up to 100,000 points (50,000 points after spending $2,000 within the first 3 months and additional 50,000 points after spending $12,000 within the first year) for any of the three personal cards: Southwest RR Plus Visa ($69 annual fee), Southwest RR Premier Visa ($99 annual fee), and Southwest RR Priority Visa ($149 annual fee).

Other than some previous offers that gave you Companion Pass status right away (but with a much smaller points bonus), either of these three current personal card offers are also considered the easiest way to achieve the potentially highly lucrative Companion Pass status, which normally requires 125,000 points accumulated within one calendar year and allows you to take a companion for free as many times as you like. If you time it right, you may get Companion Pass for almost two years. This is how: apply one of the three personal cards right before the current offer ends (12/1/2021), and spend $25K (or less if you also spend in bonus categories) in the statement which ends after 1/1/2022 (you may adjust the due date so that the statement ending date falls on, e.g., 1/1/2022, so your spending rewards for December as well as the 100K signup bonus will count towards 2022 calendar year). Spending $25K in one month might be a challenge for most of us, and we might consider options such as paying property taxes with the card, recharging your Amazon account balance which you will use down the road, or buying some gift cards for merchants you will shop anyway. Of course, there is nothing wrong to spread your spending over a few months or actually fly with Southwest to earn some points or even picking up a new Southwest Business card for either 60K or 80K points (make sure your signup bonus posts in 2022). While you can't receive both signup bonuses on two personal Southwest cards, you can receive both if you open one personal card and one business card. If you do think about signing up both personal and business cards, you might have two different strategies: (1) open one personal card and spend $2,000 to get 50K points, and Performance Business Card and spend $5,000 to get 80K, which puts you over the 125K points threshold, and of course you might want to spend another $10K on the personal card down the road to get the remaining 50K which is still a great deal; (2) open one personal card and spend $12,000 to get 100K points, and Premier Business Card and spend $2,000 to get 60K, which also puts you over the 125K threshold, but with double spending in the short term and no more worries in the longer term. The bottom line is that you will earn Companion Pass for the rest of the calendar year (2022) in which you complete the 125K points qualification requirement and the following calendar year (2023). The business cards are still offering the same bonuses as before: 60,000 points for Southwest RR Premier Business Visa ($99), and 80,000 points for Southwest RR Performance Business Visa ($199). In addition, there are several new benefits introduced for these cards as below:

Capital One has surprised us again with the improvement brought to its Capital One (C1) Miles rewards program. The transfer ratio of the following six airline partners has been improved:

Obviously, with this increased valuation, Venture Card and Spark Miles Business Card, both offering 2x Miles (=3% travel rewards) on everything with a $95 annual fee, are becoming better than ever before. Venture Card now takes the top spot from Citi Premier as the Best Credit Card for Rewards and also jumps from #6 to #3 on our Top 10 Best Credit Cards list. On the other hand, Spark Miles is considered the best business card for spending, alongside with Amex Blue Business Plus. Below is the before/after comparison of our Top 10 list. Chase has brought several enhancements to its popular Sapphire Preferred (CSP) and Sapphire Reserve (CSR). The annual fees ($95 on CSP and $550 on CSR) are kept the same. We think CSP's enhancements have been long overdue because the non-fee duo Freedom Flex and Freedom Unlimited have offered some similar bonus categories for a while. With a reasonable annual fee, CSP is now #3 best credit card for rewards. While we think CSR has been competitive even after Chase increased the annual fee from $450 to $550 last year mostly due to the COVID related temporary benefits, we certainly welcome the new benefits which will keep this card one of our top recommendations. With these enhancements, CSR and CSP now take the first and second spots on our Top 10 list. Citi Prestige was taken off the list because it has been discontinued to new applicants. Below are the before and after Top 10. Chase Sapphire Preferred Enhancements (effective August 16, 2021)

Chase Sapphire Reserved Enhancements (Effective August 16, 2021)

|

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed