- There were a few new developments for Marriott Bonvoy cobranded credit cards in September. Two new $250 cobranded cards were introduced: Chase Marriott Bonvoy Bountiful Visa Signature and Amex Marriott Bonvoy Bevy Card. They are almost identical in signup bonus (125,000 points), rewards, and perks, except for some Visa/Amex related benefits. However, we won't recommend either except for the signup bonuses because of the lack of good perks. Both offer an annual 85K-point free night when you spend $15,000 per calendar year, not very attractive considering annual fees and the spending requirement. See our reviews for details.

- Amex also updated Marriott Bonvoy Brilliant Card by increasing the annual fee from $450 to $650 and introducing a few changes: (1) annual free night's cap is increased from 50,000 points to 85,000 points, (2) complimentary Marriott Gold Elite status is replaced by Platinum Elite status (which previously required $75,000 annual spending), (3) annual "earned choice award" for $60K spending is added, (4) annual night credits towards elite status are increased from 15 nights to 25 nights, and (5) annual $300 Marriott statement credits are replaced by $300 dining statement credits (up to $25 monthly credits). In our opinions, the perks are not very impressive considering the high annual fee, especially if you don't stay at Marriott that often.

- Introduced earlier this year with in-branch only application, Chase Ink Premier BUSINESS Card is finally available online. Note that the Ultimate Rewards points earned from this card cannot be transferred to frequent traveler miles/points or to your other Ultimate Rewards accounts. So you should treat it as a cashback card which offers $1,000 at signup with a $195 annual fee.

|

0 Comments

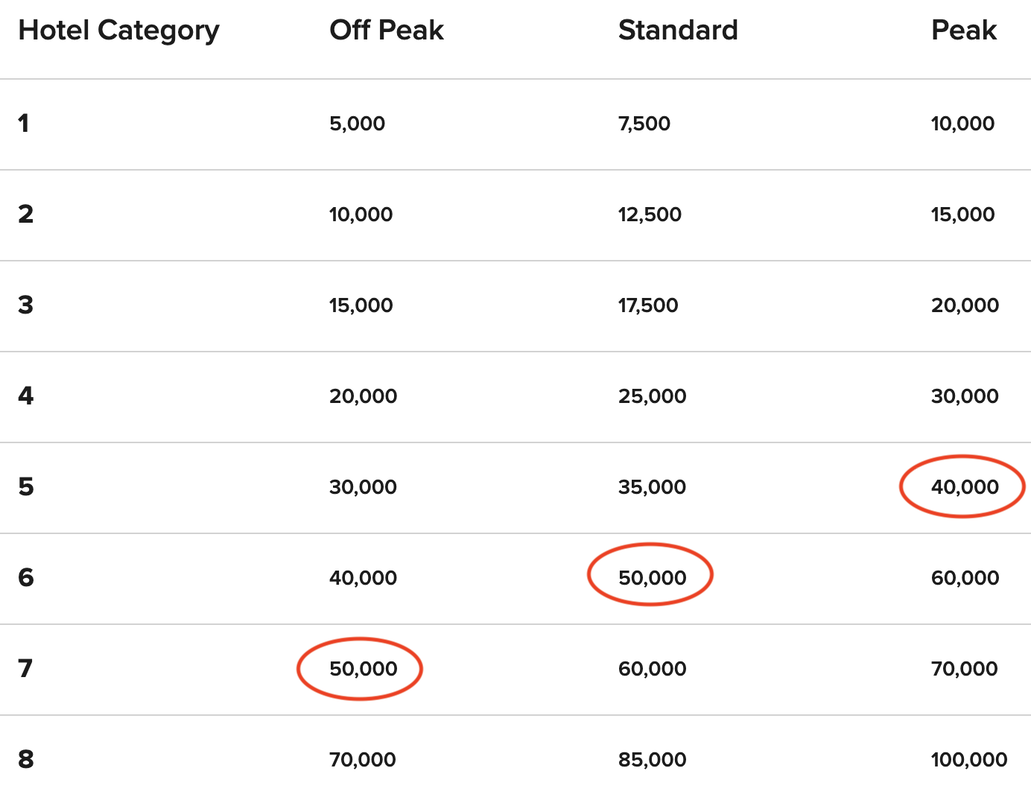

It is a good thing that Chase has brought back the best offer for its Marriott Bonvoy Boundless Visa after two years. You will receive five free nights at Marriott portfolio hotels, each with a redemption level up to 50,000 points, after you spend $5,000 within 3 months of new account opening. The free night e-certificate expires 12 months after issuance; you might also top off the free night certificate with your own Marriott points, up to 15,000 additional points for a higher redemption level. We value each of the free night certifications close to 50K Marriott points (for hotel redemptions only): $300 for each certificate, valued at 0.6 cents per point, because the flexibility of topping off free nights. The signup bonus minus annual fee is worth $1,450 in our book!

Another round of amazing signup offers and this time is for four Marriott Bonvoy co-branded credit cards:

Chase introduces more temporary bonuses to its credit card portfolio for November and December 202010/31/2020 Chase has introduced temporary benefits on more of its credit cards. In a recent post, we covered Chase Sapphire series, Ink series, and Freedom series. Now select cardmembers will receive the following category bonuses between 11/1/2020 and 12/31/2020; you need to activate the offer through a link in the promotional email or at chase.com/mybonus directly.

In addition, not from Chase or Amex, the following hotel program policies are recently announced:

Finally, to track all the COVID-19 related temporary credit card benefits, please visit our featured review which has been under continuous update with the most recent updates highlighted in cardinal. In response to Chase Marriott Bonvoy Boundless Visa's crazily lucrative five free 50K-nights offer, Amex has also brought us very impressive offers for both the Marriott Bonvoy Brilliant Card and the Marriott Bonvoy Business Card:

Chase Marriott Bonvoy Boundless best bonus ever: five free nights, each capped at 50,000-point level10/1/2020 Chase has brought us an amazing signup offer for Marriott Bonvoy Boundless Visa Signature:

COVID-19 pandemic has obviously changed consumer behavior big time, and it makes sense that credit card issuers are making adjustments accordingly. This post summarizes these adjustments from Amex, Chase, and Citi.

American Express

Chase

Citi

After Citi's September overhaul and Barclay's November overhaul of their credit card protection benefits, Amex will also have some major changes coming on January 1, 2020. Here are the breakdowns of the upcoming changes.

Overall, the changes are mixed - some gain and some loss - but not as bad as Citi's drastic devaluation. The cards that benefit from the changes are probably limited to those with an annual fee at least $450 - Platinum Card (personal and business), Delta Reserve (personal and business), Hilton Aspire, and Marriott Bonvoy Brilliant; the rest of the cards are generally considered to receive reduced coverage. We think most cardholders will be unhappy about the changes. We will update our Protection page once these changes kick in. There are quite a few updates on the website in the recent weeks, and here is a quick roundup.

This week we have seen some elevated signup bonuses on a few credit cards (our value for the bonus minus first year annual fee is for your reference - your valuation may vary):

|

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed