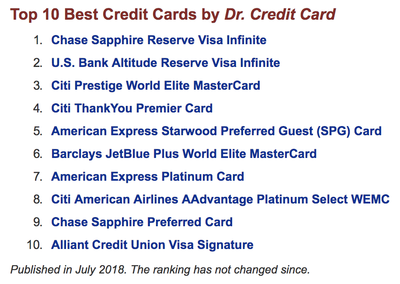

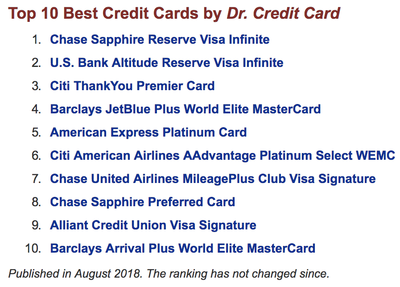

In addition, we regularly review the current and recent (within a year) signup bonuses as well as the availability of the top credit cards for adjustment of our ranking. As a result, our Top 10 Best Credit Cards list has been updated. Below is a before and after comparison.

|

August 26, 2018 is a date when several Chase credit card related changes kick in. First of all, Chase has eliminated two consumer protection benefits: Price Protection (for all Chase cards) and Return Protection (for Sapphire Preferred, Freedom, Freedom Unlimited, Ink Preferred, United Explorer, and probably other products). Secondly, Korean Air which used to be a great transfer partner for redeeming Ultimate Rewards points has been removed; on the other hand, JetBlue is added as a transfer partner and the transfer ratio of 1:1 is actually better than the competitors' (Amex Membership Rewards, Citi ThankYou, Marriott Rewards). Lastly, JPM Ritz-Carlton Visa Infinite, which has been discontinued to new applications since late last month, receives two enhancements for its existing cardmembers - an annual Marriott portfolio free night capped at 50K points and one extra point earning for all categories. If you currently have this card, there are many reasons to keep it as long as you can. In addition, we regularly review the current and recent (within a year) signup bonuses as well as the availability of the top credit cards for adjustment of our ranking. As a result, our Top 10 Best Credit Cards list has been updated. Below is a before and after comparison. As you can see, Amex SPG Card, which used to be a powerhouse for general spending, has disappeared from the list because the earning rate has been reduced from 3x Marriott points (i.e. 1x SPG points in the old system) to 2x Marriott points as of August 1, 2018. Citi Prestige, which has been pulled from Citi website and unavailable to new applications but will be relaunched in the near future, has been removed as well (hopefully temporarily). Chase United Club Visa is now #7 due to the consistent signup bonus of 50K miles. Also note that the enhanced JPM Ritz-Carlton Visa could have landed on this prestigious list for the very first time and also replaced Amex Platinum Card as the #1 Credit Card for Perks if it has not been discontinued to new applications, and unlike Citi Prestige, it seems that Chase has no plan of relaunching this premium card due to the Marriott-Amex-Chase agreement that makes Amex the issuer of premium Marriott credit card.

6 Comments

American Express Starwood Preferred Guest (SPG) Luxury Card is finally here, with a 100K signup bonus. Our review is now alive. The card is totally worth keeping after the first year thanks to the annual $300 Marriott credits and the free night capped at 50K points level. For your information, the new Marriott program has 8 redemption categories, and 50K points are required for a Category 6 standard awards night. We have also updated the High-end Credit Card Comparison, as well as quite a few related reviews.

The Facts

The Math First of all, the effective annual fee of Amex SPG Luxury Card is very reasonable at $150 after considering the easy-to-use $300 annual Marriott credits. With that, you receive several valuable perks including the 50k-point free night, 15 elite qualifying night credits, and Priority Pass Select membership. Even though Marriott points are probably our favorite frequent traveler currency (thanks to Marriott's decision of keeping SPG's best feature), the earning rate of 2x points in the general spending category offered by this card (as well as any other Marriott credit cards) is not that impressive, especially compared to the old Amex SPG which technically returned 3x Marriott points for general spending. Our current valuation of Marriott points is 0.75 cent a piece, which means that this card returns 1.5%, 2.3%, 4.5% travel rewards for the 2x, 3x, and 6x categories, respectively. For general spending, you might want to consider a 2% cashback card without annual fees (such as Citi Double Cash) or a miles credit card with potential higher return such as Amex EveryDay Preferred (which returns 2.25% travel rewards when you have at least 30 transactions per month) and Chase Freedom Unlimited (which returns 2.25% travel rewards when you pair it with Chase Sapphire Reserve or similar premium UR cards). The bottom line is that we won't recommend this card for spending, probably except for purchases at Marriott hotels. In this way, this card is considered a great "drawer card". How about spending $75K to get the lucrative Marriott Platinum status? Let's use 2% cashback as the benchmark - your "complimentary" Marriott Platinum essentially costs you $75,000 x (2% -1.5%), i.e., $375 per year. This may be reasonable for some travelers but probably not for most. Amex SPG Luxury vs. Amex SPG: the effective annual fee on the SPG Luxury Card is only $55 more than the lower-tier SPG Card. With that, you get a 50K-point free night instead of a 35K-point free night, Marriott Gold for free instead of spending $35K, the potential Marriott Platinum after $75K spending, as well as Priority Pass Select membership, Premium Roadside Assistance, etc. It is almost a no-brainer to pick the more expensive card as long as you stay at least a few nights at Marriott portfolio hotels. Amex SPG Luxury vs. Amex Hilton Aspire: As the flagship credit card in each of their program, each card carries a $450 annual fee and offers complimentary Priority Pass Select membership with unlimited access for you plus two. How do they compete with each other? Let's first compare the annual statement credits - SPG Luxury offers $300 for any Marriott portfolio hotel purchases, while Hilton Aspire offers $250 for airline incidentals plus $250 for Hilton portfolio resorts; obviously, SPG's credits are easier to use, but Hilton's total credits are $200 more - considering both the absolute value and how easy to use, we call it a draw. Secondly, let's look at the annual free nights - Hilton Aspire wins this one as the annual free weekend night can be redeemed at any Hilton portfolio hotels, while SPG Luxury's free night is capped at 50K-point properties (a top-tier hotel requires 70K-100K). Thirdly, Hilton Aspire's complimentary Diamond status again blows SPG Luxury's complimentary Gold status out of water. Marriott Platinum status will be a good match of Hilton Diamond status, but it does require a whooping $75K annual spending on the card. Lastly, while we don't recommend either card for general spending, charging the hotel purchases to either card does make sense and the value actually compares well - Hilton Aspire's 14x points (5.6% cash equivalent return in our book) vs. SPG Luxury 6x points (4.5% in our book and offering more flexibility due to the valuable airline miles transfer). In general, Amex Hilton Aspire packs more value in our opinion, but which to pick actually heavily depends on which frequent guest program you are more loyal to. To see how Amex SPG Luxury Card competes with other cards with similar annual fees, please check out our featured review Comparing High-end Cards covering Amex Platinum Card, Amex Delta Reserve, Amex Hilton Aspire, Amex SPG Luxury, Chase Sapphire Reserve, Chase United MP Club, Citi Prestige, Citi AA Executive, U.S. Bank Altitude Reserve, CNB Crystal, and MasterCard Black Card. The Conclusion Amex SPG Luxury, with the annual $300 Marriott credits and the anniversary free night, is such a great card to keep without ever spending a dime on, even for travelers that only stay at Marriott portfolio hotels just a few times a year. For travelers that frequent Marriott, this card's 6x points on Marriott purchases, 15 elite qualifying night credits, and the potential Marriott Platinum after $75K spending, are all worth looking into. It is currently rated as one of Best Credit Cards for Perks. With the final integration of Marriott Rewards and Starwood Preferred Guest (SPG) programs, we have updated our Featured Review: Marriott Rewards vs. Membership Rewards (MR) vs. Ultimate Rewards (UR) vs. ThankYou (TY) vs. Club Rewards (CR).

In this review we will compare five most popular and versatile rewards programs in the market. They are similar in that their points can be transferred into miles/points of a number of frequent traveler programs (airlines/hotels). Marriott Rewards Marriott Rewards is the frequent guest program of Marriott International whose hotel portfolio includes Ritz-Carlton, St. Regis, Luxury Collection, JW Marriott, EDITION, W Hotels, Marriott, Renaissance, Delta, Gaylord, Autograph Collection, Sheraton, Westin, Le Meridien, Tribute Portfolio, Design Hotels, Courtyard, AC Hotels, Fairfield, SpringHill Suites, Protea, Moxy, Four Points, element, aloft, Residence Inn, TownePlace Suites, Marriott Executive Apartments, and Marriott Vacation Club. Marriott points can be valuable when redeemed for hotel stays in Marriott portfolio hotels. Here we don't want to go into details of hotel redemption, please visit marriott.com for more information. Marriott points can be extremely valuable when transferred into miles of 40+ frequent flyer programs, mostly at 3:1 ratio. This ratio may seem low compared to other programs, but you have to understand this essentially represents the same value as the old Starwood Preferred Guest (SPG) points which transfer to airline miles at 1:1 and to Marriott points at 1:3 before the final integration of Marriott Rewards and SPG programs. In fact, with the merger, the number of airline partners actually further increased from 34 to 44. As Marriott points are generally obtained more easily than the points in the other programs in this review, they do continue to represent great value.

Most importantly, if you transfer 60,000 points you receive a bonus of 15,000 points, i.e., 60K Marriott points = 25K miles, or 2.4 Marriott points = 1 mile of most partners. You can transfer your Marriott points to a household member's Marriott account but there is paperwork you will have to do and sign. However, you can only transfer your Marriott points to a frequent flyer account under your name. In addition, you might redeem Marriott points for the Travel Packages (Hotel + Air Packages): your points will be converted to a certain number of frequent flyer miles plus a seven-night hotel certificate at a certain redemption level. Marriott revamped the Hotel + Air charts in August 2018, with major devaluation. The new travel packages do not represent good value compared to the simple miles transfer without the hotel certificate; for example, you might redeem 330K Marriott points for 100K miles plus a 7-night certificate at Category 1-4 hotels - you essentially only save 60K points for the hassle of finding a single hotel to stay for 7 consecutive nights. Membership Rewards (MR) from American Express On the earning side, you earn one extra point for each dollar spent on travel booked through MR (American Express Travel); however, Amex charges a booking fee on airfare or air-hotel packages ($6.99 per domestic ticket; $10.99 per international ticket) so most likely it is not a good deal. Effective May 2015, Amex waives the booking fee for Platinum and Centurion cardmembers. Amex used to have a shopping portal that allowed you to earn up to 10X bonus points; however, it was closed in 2013. On the redemption side, MR points can be redeemed for merchandise, gift cards, travel (Pay with Points), and so on, at up to 1 cent per point. However, some cards are eligible for a transfer feature that allows points to be transferred to over 20 frequent traveler programs. Let's look at these two groups:

MR points can be transferred into miles or points of the following programs: Airline Partners

Compared to airline miles transfer, hotel points transfer does not represent good value. Even though MR does not have the built-in 25% transfer bonus like Marriott, Amex runs limited-time transfer promotions on certain partners several times a year, so the value of MR points can be higher. Another huge advantage of MR over Marriott is that the transfer to most partners is instantaneous rather than days or weeks. This can be very useful when you find a particular award ticket available and want to grab it immediately before it is taken. The downside of MR is that Amex charges 0.06 cent per point up to $99 for transfer to domestic airlines. For example, if you transfer 100K points to 100K Delta miles, you will be charged $60 for the transaction. You can not transfer your MR points to someone else's MR account. However, you can transfer your MR points to your authorized user's frequent traveler accounts. Three Ways of Using MR points for Airfare: In addition to the aforementioned two options to redeem MR points for airfare - Pay with Points (fixed value, 1 cent per point) and the transfer feature, Amex also offers certificates for economy tickets for the following airlines: Cathay Pacific, Swiss, Qantas, and South African Airways. Note that they (except Swiss) are not transfer partners: you can't transfer MR points to their miles but you rather use a bulk of points in exchange for certificates that can be used for economy tickets (or companion tickets). The use of certificates is not subject to capacity control and you can actually earn miles on them. There is no certificates for business or first class tickets. For example, using the certificate a round-trip economy ticket on Swiss from SFO/LAX to Europe costs 65K points no matter how much the revenue ticket actually costs. If you use Pay with Points feature and the revenue ticket costs $1,000, you will need 100K points. For comparison, if you want to use Swiss' own frequent flyer program - Miles and More, which by the way is a transfer partner of Marriott, it will cost 50K miles plus fuel surcharge (which can be as high as, say $400) and is subject to capacity control. Ultimate Rewards (UR) from Chase Chase Ultimate Rewards (UR) is a knock-off of Amex Membership Rewards. On the earning side, you earn one extra point for one dollar spent on airfare booked through UR, but unlike Amex, Chase does not charge a booking fee. You also earn up to 10x points when shopping through UR. The regular UR program allows redemption for merchandise, gift cards, cash, and travel, at up to 1 cent per point. However, premium UR cards including Sapphire Preferred ($95), Sapphire Reserve ($450), JPM Reserve ($450), and Ink Preferred ($95), have two premium redemption features: one is 25% bonus to travel redemption via UR (1 point = 1.25 cent); the other is to transfer points into miles/points of frequent traveler programs. Just like MR, transfer from UR to miles/points is instantaneous. Also like MR, if you have a regular UR card such as Freedom and another premium UR card such as Sapphire Preferred, you can pool all UR points together and enjoy the premium features. You can transfer your UR points to the UR account or a frequent traveler account belonging to one household member. Points transfer to third parties is prohibited. Currently, UR has the following partners: Airline Partners

ThankYou (TY) from Citi For several years, Citi's ThankYou Rewards (TY) had been lagging behind with only one transfer partner Hilton HHonors (this relationship ended in December 2017), and we were excited to see that Citi finally introduced several airline partners in July 2014. Currently there is no points earning for shopping with Citi. The regular TY program allows redemption for merchandise, gift cards, statement credit, and travel, at up to 1 cent per point. However, premium TY cards including Citi ThankYou Premier ($95), Citi Prestige ($450), and Citi Chairman, have a transfer feature similar to Marriott, MR, and UR, that allows ThankYou points to be transferred to frequent traveler programs. If you have a regular TY cards such as ThankYou Preferred, you may pool all your points together and the points earned through the regular TY cards become eligible for transfer. You may share your TY points with someone else; however, the shared points will expire in 90 days. You can only transfer your TY points to a frequent traveler account under your name. TY partners include the following:

Club Rewards (CR) from Diners Club Club Rewards from Diners Club has always had the transfer feature that allows points to be transferred to miles/points. Club Rewards points earned from Diners Club cards such as Diners Club Premier ($95) and Diners Club Elite ($300), both of which hasn't been accepting new applications since late 2014, can be redeemed for merchandise, gift cards, cash, travel, etc., at up to 1 cent per point. In addition, CR points can be transferred to the following frequent traveler accounts, mostly at 1:1: Airline Partners

For the master comparison chart, please see the updated review. We finally review the relaunched Wells Fargo Propel Amex, which drops the annual fees and expands bonus categories. When you also have Wells Fargo Visa Signature, Propel Amex is a powerhouse for bonus category rewards (travel & gas & dining & streaming) and poses a great challenge to some of our favorite credit cards.

The Facts

The Math Because Wells Fargo Go Far Rewards program does not allow points to be transferred to frequent traveler miles/points, the value of this Amex heavily depends on whether you have another Well Fargo card (Visa Signature) to achieve the redemption value of 1.5 cpp (or even 1.75 cpp when annual spending exceeds $50K). Let's first look at how difficult it is to achieve 1.75 cpp value. If you spend $50K on the Visa Signature, you essentially lose $50,000 x (2% - 1.75%) = $125 per year, compared to the 2% cashback you can easily earn with quite a few non-fee cards (such as Citi Double Cash). In the meantime, you gain an additional (1.75 - 1.5)% x 3 = 0.75% on the 3x bonus categories with Propel Amex. Thus, you will need to spend at least $16.7K on the 3x categories to offset the $125 you lose on general purchases, as $16.7K x 0.75% = $125. To hit the maximum 1.75 cpp value and still come out ahead, you will need to spend $50K on non-bonus categories with Visa Signature and $16.7K on 3x categories with Propel Amex, which is nevertheless a very tough requirement. The bottom line is that 1.75cpp value looks amazing on paper but is not easily achieved in reality. So let's use the more realistic 1.5 cpp value in our analysis. With the Visa Signature in your drawer, Propel Amex is able to cover a wide range of 3x bonus categories: airfare, non-airfare travel, dining, gas, and streaming, with a return rate of 4.5% rewards. The return rate for general spending at 1.5% is not bad either. However, we still recommend a 2% cashback card for general spending instead. Wells Fargo Propel Amex vs. Citi ThankYou Premier: First of all, Citi ThankYou Premier carries a $95 annual fee while Wells Fargo Propel Amex has none. Currently, points in the two programs have similar values in our book (assuming you have Wells Fargo Visa Signature). Propel Amex returns 3x points on travel & gas & dining & streaming, while ThankYou Premier returns 3x points on travel & gas and 2x dining & entertainment. Obviously, while the old Propel World Amex failed to match ThankYou Premier, the updated Propel Amex actually leaves ThankYou Premier in the dust with regards to bonus categories. The most important difference between the two, however, is how the 1.5 cpp value is achieved: on Propel Amex, you redeem for airfare at a fixed rate of 1.5 cpp when you also have Wells Fargo Visa Signature; on ThankYou Premier, this value could only be achieved when you transfer ThankYou points to miles of airline partners, usually for premium cabin awards tickets. Wells Fargo Propel Amex vs. Chase Sapphire Reserve (CSR): The updated Propel Amex nows poses a great challenge to our favorite CSR. First of all, even considering the $300 annual travel credits, CSR's effective annual fee is still $150. Secondly, Propel Amex offers two additional 3x categories - gas & streaming. Looks like on paper, Propel Amex has CSR beaten up pretty badly. However, CSR's $150 effective annual fee gets you quite some nice perks such as airport lounge access, luxury hotel privileges, primary rental car coverage, and better consumer travel and purchase protection. In addition, while Ultimate Rewards points earned from CSR might be redeemed for airfare at the same fixed value of 1.5 cpp, they might also be transferred to miles of airline partners, recommended for premium cabin awards tickets. Lastly, getting Propel Amex to hit the magical 1.5 cpp does require having another Wells Fargo card. If you haven't had Wells Fargo Visa Signature, it is recommended to get Propel Amex first with the signup bonus, start using it for 3x categories, and open Visa Signature six months later to activate the 1.5 cpp value. Wells Fargo Propel Amex vs. US Bank Altitude Rewards: Unlike Citi ThankYou or Chase Ultimate Rewards programs, US Bank Altitude Rewards doesn't have a miles transfer feature. So a comparison between Wells Fargo Propel Amex and US Bank Altitude Rewards Visa is much easier, as both have the fixed 1.5 cpp value for airfare redemption. Altitude Rewards has an effective annual fee is $75 after considering the annual $325 travel credits and offers some premium perks such as airport lounge access, luxury hotel privileges, primary rental car insurance, and GoGo inflight internet. When it comes to rewards, Altitude Rewards returns 3x points on travel & mobile payment services, while Propel Amex returns 3x travel & gas & dining & streaming - we think Propel Amex has better rewards for most consumers. So if you don't need the travel perks from Altitude Rewards or you have received similar perks from other cards, Propel Amex will be a better card, as long as you also have Wells Fargo Visa Signature. The Conclusion With the relaunch of Propel Amex, which drops the annual fees all together and expands bonus categories substantially, Wells Fargo tries very hard to earn customers. We welcome the positive changes. When you have Wells Fargo Visa Signature to increase points value to 1.5~1.75 cpp, Propel Amex is a powerhouse for a wide range of bonus categories and poses a serious challenge to some of our favorite cards such as Chase Sapphire Reserve and US Bank Altitude Rewards. This is not the first time Amex runs this kind of promotions for its Delta cobranded SkyMiles Credit Cards, and won't be the last one. Now through 9/19/18:

As our current valuation for Delta miles and its MQMs are around 1 cent a piece, the signup bonus after considering the first year annual fee for either of these four cards is roughly $600. Barclays American Airlines Aviator Red WEMC has increased the signup bonus from 50K miles to 60K miles (the best ever offer), still just after your make the first purchase (which is very rare these days). Our review has been updated too to reflect the post- Amex SPG discussions (see below).

The Facts

The Math In the past we used to not recommend this card for general spending, as the old Amex SPG (before August 2018) returned 25% more AA miles than any AA cobranded cards. Effective August 2018, AA cobranded credit cards have become the best way of earning AA miles via credit card general spending. AAdvantage Aviator Red vs. AAdvantage Aviator Silver: Aviator Silver is $100/year more expensive than Aviator Red, and it comes with three premium features: (1) a 3-2-1 earning structure vs. 2-1 on Red (one additional mile on American, hotels, and car rentals), (2) EQM earning potential with $25K-50K spending, and (3) annual $99 companion certificate with $30K spending. Even if you don't use the last two, you just need to spend $6,250 a year on American airlines, hotels and car rentals to come ahead of the $100 difference in annual fees if you happen to value an AA mile at 1.6 cents a piece like we do, as $6,250 x 1 mile/$ x 1.6 cent/mile = $100. Of course, if your value is different, you can do your own math. The bottom line is that if you are a frequent American flyer, you will most likely find upgrading to Silver Aviator a great deal. AAdvantage Aviator Red vs. Citi AAdvantage Platinum Select: These two cards are direct competitors - they share many features. Their differences are: (1) Citi's version has a $99 annual fee ($4 more than Barclays') but waives it for the first year; (2) Citi's version offers 2x dining and gas; (3) Citi's version offers Reduced Mileage Awards (saving 7,500 miles on select routes); (4) Citi's version offers $100 flight discount after $20K annual spending; (5) Barclays's version offers 3K Elite Qualifying Dollars after $25K annual spending. The Conclusion Barclays designs the replacement of US Airways MasterCard to align with Citi's counterpart. However, if you frequent American or just have big hotels/rental cars spending, you will find upgrading from Aviator Red to Aviator Silver very rewarding. Chase IHG Rewards Club Premier World Elite MasterCard now has a 105K + $50 credit signup bonus, the best we have ever seen on this card or the card it replaced (IHG Rewards Club Select MC). The $89 annual fee is not waived for the first year. The signup bonus: $50 statement credit after the first purchase + 100,000 points after spending $3,000 within 3 months of new account opening + additional 5,000 points after adding one authorized user and making the first purchase within the same 3-month period. The bonus is not available if you currently have this card or have received a signup bonus for this card in the past 24 months. Note that this card is NOT subject to Chase' infamous 5/24 rule (you won't be approved for a new card if you have opened 5 or more new accounts within the past 24 months).

So do you apply now?

Our review on Amex SPG Card has been updated as the following.

American Express Starwood Preferred Guest Card (personal)

American Express Starwood Preferred Guest BUSINESS Card

The Math As Marriott points are normally valued at less than 1 cent per point (0.75 cpp in our book), this card is decent for general spending. Based on our value, this card returns 1.5% travel rewards and will be outshined by a 2% cashback card (such as Citi Double Cash or Fidelity Visa). However, if you points valuation is higher or if you know how to maximize points value (especially when transferred to frequent flyer miles), you might still find this card better than 2% cashback cards. In addition, 6x points at Marriott portfolio hotels (and 4x dining, gas, wireless and shipping on the business version) may be another reason to spend on this card, because 4.5% travel rewards hold up well to the competition, especially considering the versatility and the large number of transfer partners of Marriott points. Even if you don't plan to spend much on the card, you might still want to keep it after the first year thanks to the annual free night capped at 35,000 points level, as well as the 15 night credits towards elite status. Actually, this is one of the few cards that you may want to pay annual fees happily but keep it in the drawer. The Conclusion The August 2018 revamp makes Amex SPG less attractive for general spending. We only recommend the card for 6x bonus category (and 4x on the business version) spending, and the annual 35K-point free night makes it a keeper after the first year. © 2018 DrCreditCard.net All rights reserved. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed