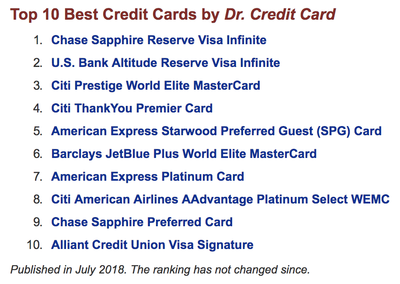

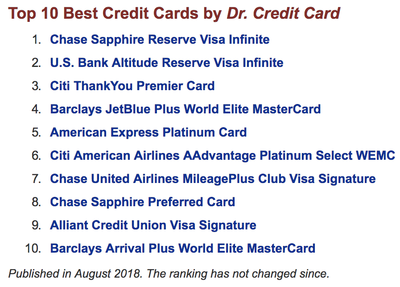

In addition, we regularly review the current and recent (within a year) signup bonuses as well as the availability of the top credit cards for adjustment of our ranking. As a result, our Top 10 Best Credit Cards list has been updated. Below is a before and after comparison.

|

August 26, 2018 is a date when several Chase credit card related changes kick in. First of all, Chase has eliminated two consumer protection benefits: Price Protection (for all Chase cards) and Return Protection (for Sapphire Preferred, Freedom, Freedom Unlimited, Ink Preferred, United Explorer, and probably other products). Secondly, Korean Air which used to be a great transfer partner for redeeming Ultimate Rewards points has been removed; on the other hand, JetBlue is added as a transfer partner and the transfer ratio of 1:1 is actually better than the competitors' (Amex Membership Rewards, Citi ThankYou, Marriott Rewards). Lastly, JPM Ritz-Carlton Visa Infinite, which has been discontinued to new applications since late last month, receives two enhancements for its existing cardmembers - an annual Marriott portfolio free night capped at 50K points and one extra point earning for all categories. If you currently have this card, there are many reasons to keep it as long as you can. In addition, we regularly review the current and recent (within a year) signup bonuses as well as the availability of the top credit cards for adjustment of our ranking. As a result, our Top 10 Best Credit Cards list has been updated. Below is a before and after comparison. As you can see, Amex SPG Card, which used to be a powerhouse for general spending, has disappeared from the list because the earning rate has been reduced from 3x Marriott points (i.e. 1x SPG points in the old system) to 2x Marriott points as of August 1, 2018. Citi Prestige, which has been pulled from Citi website and unavailable to new applications but will be relaunched in the near future, has been removed as well (hopefully temporarily). Chase United Club Visa is now #7 due to the consistent signup bonus of 50K miles. Also note that the enhanced JPM Ritz-Carlton Visa could have landed on this prestigious list for the very first time and also replaced Amex Platinum Card as the #1 Credit Card for Perks if it has not been discontinued to new applications, and unlike Citi Prestige, it seems that Chase has no plan of relaunching this premium card due to the Marriott-Amex-Chase agreement that makes Amex the issuer of premium Marriott credit card.

6 Comments

Phil

8/26/2018 04:02:46 pm

The AMEX/Chase agreement as you point out gives AMEX the right to market the high end/premium cards while Chase has rights to the mass market cards. The JP Morgan Ritz Carlton card is closed to new applicants (per the agreement). Does this mean that the regular AMEX SPG card (mass market) will be closed to new applicants as well? If not, it seems that AMEX gets the better deal with the ability to offer both a mass market and premium card (SPG Luxury).

Reply

Dr. Credit Card

9/1/2018 10:14:21 am

To be honest, the details in the Marriott-Chase-Amex agreement is unknown. The only things we know are from the announcement from Marriott back in December 2017: "Marriott expects to introduce new, co-brand products starting in 2018 with enhanced member benefits – super-premium consumer and small business co-branded products from American Express and mass consumer and premium consumer co-branded products from JPMorgan Chase. Additional details on the future products will be shared in 2018. In the meantime, both companies will retain their existing portfolio of accounts and continue to offer their current products." However, there was no mentioning of whether the Ritz-Carlton co-branded credit card by Chase or personal "premium consumer" credit card by Amex i.e. personal Amex SPG will be discontinued. The fact that Chase has discontinued Ritz-Carlton Visa (to new applicants) has made many people (me included) to speculate that Amex will have exclusive right to the "super premium" product moving forward. If that's indeed the case, maybe personal Amex SPG and Chase Marriott Business will be discontinued to new applicants at some point down the road, while business Amex SPG (which of course will be rebranded as a Marriott card at some point), personal Chase Marriott Consumer (no-fee) and personal Chase Marriott Premier Plus will be continued. As the agreement is multi-year, we really have no idea how it will be implemented at this moment.

Reply

Dr. Credit Card

9/1/2018 10:18:00 am

To your question regarding multiple Marriott cards, I do see many reasons to keep them, primarily for multiple free nights. Looks like the fact you have Ritz-Carlton Visa will disqualify you from getting bonus on SPG Luxury, it think it is logical to consider upgrading the regular SPG Amex to SPG Luxury as long as you are willing to pay $55 (effectively) for the difference between a 35K- and a 50K- free night.

Reply

Phil

9/3/2018 10:03:35 am

I just applied and was approved for the AMEX Hilton Aspire card. I'm going to spread my hotel loyalties around a bit more. And frankly, until Marriott finds and credits almost 210,000 SPG points to my "combined" SPG/MR account, I'm not doing any business with Marriott!

Dr. Credit Card

9/7/2018 09:07:35 am

Hilton Aspire is such a great card to have, arguably the best hotel credit card currently available. It is on par with the Ritz-Carlton Visa and way better than SPG Luxury.

Reply

Leave a Reply. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed