At the same time, the Starwood Preferred Guest Business Card from American Express is rebranded as the Marriott Bonvoy Business American Express Card. The only thing that changes other than the name is the annual fee - increased from $95 to $125 and NOT waived for the first year any more. However, if you apply before 3/28/19, you will continue to receive the first annual fee waiver and your annual fee after the first year will be grandfathered in at $95. You will also receive 100,000 Marriott Bonvoy points after spending $5,000 within the first 3 months. If you have been thinking about applying for this card, you probably want to do it before March 28.

|

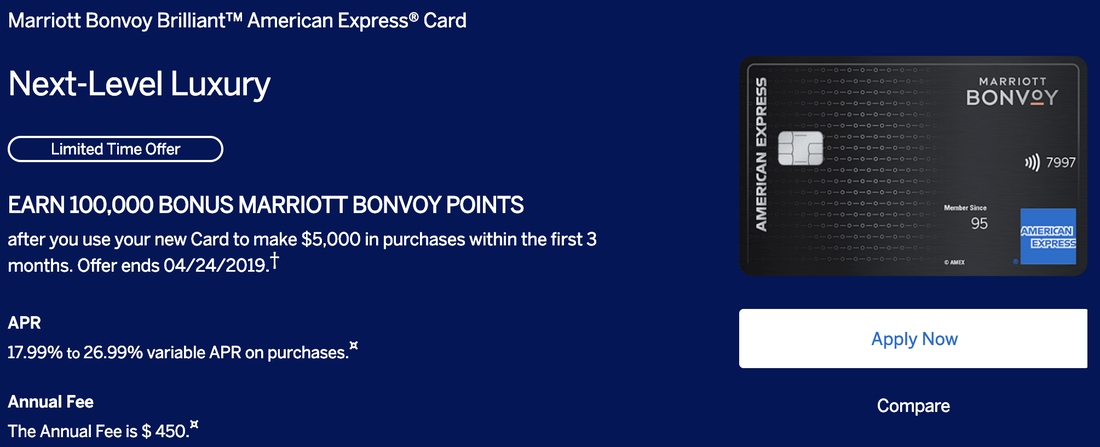

With the new name for the world's largest loyalty program unveiled, the Starwood Preferred Guest American Express Luxury Card is finally rebranded as the Marriott Bonvoy Brilliant American Express Card. Everything remains the same but the name - including (1) the $450 annual fee, (2) 100,000 Marriott Bonvoy bonus points after you spend $5,000 within the first 3 months of new account opening, (3) annual $300 credits at any Marriott portfolio hotels worldwide, (4) an annual free night at Marriott portfolio hotels or resorts with a redemption level of 50,000 points or less, (5) annual 15 night credits towards Marriott elite status, (6) free Marriott Gold status and upgrade to Marriott Platinum status after $75K annual spending, and (7) Priority Pass Select membership with unlimited airport lounge access for you plus two guests.

At the same time, the Starwood Preferred Guest Business Card from American Express is rebranded as the Marriott Bonvoy Business American Express Card. The only thing that changes other than the name is the annual fee - increased from $95 to $125 and NOT waived for the first year any more. However, if you apply before 3/28/19, you will continue to receive the first annual fee waiver and your annual fee after the first year will be grandfathered in at $95. You will also receive 100,000 Marriott Bonvoy points after spending $5,000 within the first 3 months. If you have been thinking about applying for this card, you probably want to do it before March 28.

0 Comments

Since we covered the changes to Citi Prestige back in November, we have been waiting for the big moment of relaunch of this legendary high-end card. As of January 4, 2019, the changes kicked in for the existing cardmembers; however, the card hasn't been available for new applications until the last day of January. Now our review of Citi Prestige is updated. Also updated is our Top 10 Best Credit Cards list - after two and a half years, Citi Prestige finally takes back the throne from the almighty Chase Sapphire Reserve! As a result, Alliant CU Visa Signature falls off the Top 10 list. Chase United MP Club Visa has surpassed Amex Platinum Card and Citi AA Platinum WEMC, as we have confirmed it retains two consumer protection coverages that are no longer available on most other Chase products - Price Protection and Return Protection. Here are the before and after screenshots of the Top 10 list: Here is the full updated review:

The Facts

The Math After considering the easy-to-use $250 annual travel credit, the effective annual fee on this card is $245. With that, this card offers an unmatched 5-3-1 rewards structure. As our current valuation of TY points is 1.5 cents per point (based on the miles/points transfer feature), this card returns 7.5%, 4.5%, and 1.5%, for the 5-3-1 categories respectively. It is not too hard to beat the $245 effective annual fee and the 2% cashback (from cards such as Citi Double Cash, Fidelity Visa), for example, when your annual spending in the 5x categories exceeds $4,455. The more you spend on the 5x or 3x categories, your annual earning over 2% will be better. Of course, for general spending, we still recommend looking somewhere else. In addition, you enjoy the excellent travel perks and consumer protection for free. Citi Prestige vs. Citi Premier: the difference in the annual fees might seem high at the first glance ($495 vs. $95), and Citi probably intends to offer Prestige only to the most affluent clients. However, after considering the $250 annual travel credit, Prestige is merely $150 a year more than Premier, and its 5-3-1 rewards are generally much more than Premier's 3-2-1 rewards - Prestige offers 2 more points on airfare and travel agencies and 3 more on dining, but 2 less points on gas and travel other than airfare/travel agencies/hotels/cruise lines. You may do your own math to see how easily Prestige comes out ahead, even with the $150 more in annual fees. For example, based on 1.5 cents per point valuation, assuming your gain in airfare/travel agencies happens to offset your loss in gas and trivial travel categories, you just need to spend $3,333 in dining for Prestige to make more sense. Of course, you receive better travel perks and consumer protection from Prestige on top of that. The bottom line is that Prestige is generally a better card. Citi Prestige vs. Chase Sapphire Reserve: First of all, both cards offer incredible rewards, perks, and protection. (1) Similarity - both cards offer Priority Pass Select, waived foreign transaction fees, concierge service, and Global Entry application credit; their hotel privileges are also similar in our opinion: Citi has 4th Night Free and World Elite Luxury Hotel Collection, while Chase offers Relais & Chateaux privileges, LHRC, and Visa Infinite Hotels; our current valuation of both ThankYou and Ultimate Rewards points are the same at 1.5 cents per point. (2) Citi's advantages - Prestige offers 2x additional points on airfare, travel agencies, and dining, as well as slightly better travel and consumer protection (including roadside assistance). (2) Chase's advantage - the effective annual fee after considering the annual travel credit is $95 cheaper on Sapphire Reserve; Chase offers 2x additional points on trivial travel categories (other than airfare/travel agencies/hotels/cruise lines); the rental car collision coverage is primary on Chase but secondary on Citi; even though 1.5 cents per point valuation for both currencies are based on frequent traveler miles/points transfer, Chase does offer better value for fixed value travel redemption (1.5 cents vs. 1 cent per point). (4) Bottom Line: with the January 2019 revamp, you only need to spend $3,167 per year in dining, airlines, travel agencies minus trivial travel categories for Citi Prestige to be a better rewards card, even with a higher effective annual fee. However, if you cannot achieve 1.5 cent value with miles/points transfer features and rely on fixed value travel redemption, Sapphire Reserve is still a great alternative. To see how Citi Prestige competes with other cards with similar annual fees, please check out our featured review Comparing High-end Cards covering Amex Platinum Card, Amex Delta Reserve, Amex Hilton Aspire, Amex SPG Luxury, Chase Sapphire Reserve, Chase United MP Club, Citi Prestige, Citi AA Executive, U.S. Bank Altitude Reserve, CNB Crystal, and MasterCard Black Card. The Conclusion Before its arch-rival Chase Sapphire Reserve came out in August 2016, Citi Prestige was the #1 Best Credit Card by Dr. Credit Card. After outshined by Sapphire Reserve for more than two years, Citi Prestige has finally regained the precious title with the January 2019 relaunch and impressive performance in rewards (#3) and protection (tied #1). © 2019 DrCreditCard.net All rights reserved. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed