- Our No. 1 credit card Chase Sapphire Reserve is now offering an online signup bonus of 50K points, down from 100K that was offered since its introduction in August 2016. However, you can still receive the 100K bonus when you walk into a branch and apply. Note that the infamous 5-24 rule (you will be denied the new account when you have opened 5 or more new credit cards in the past 24 months) still applies when you do that. Hurry up if you haven't got this amazing card - source says the in-branch 100K offer will last through March but you never know if Chase decides to pull it earlier.

- Barclays has made American Airlines Aviator Red MasterCard available to new customers, with a signup bonus of 40K. This means Citi is no longer the sole issuer of American Airlines' credit card products. We welcome the competition.

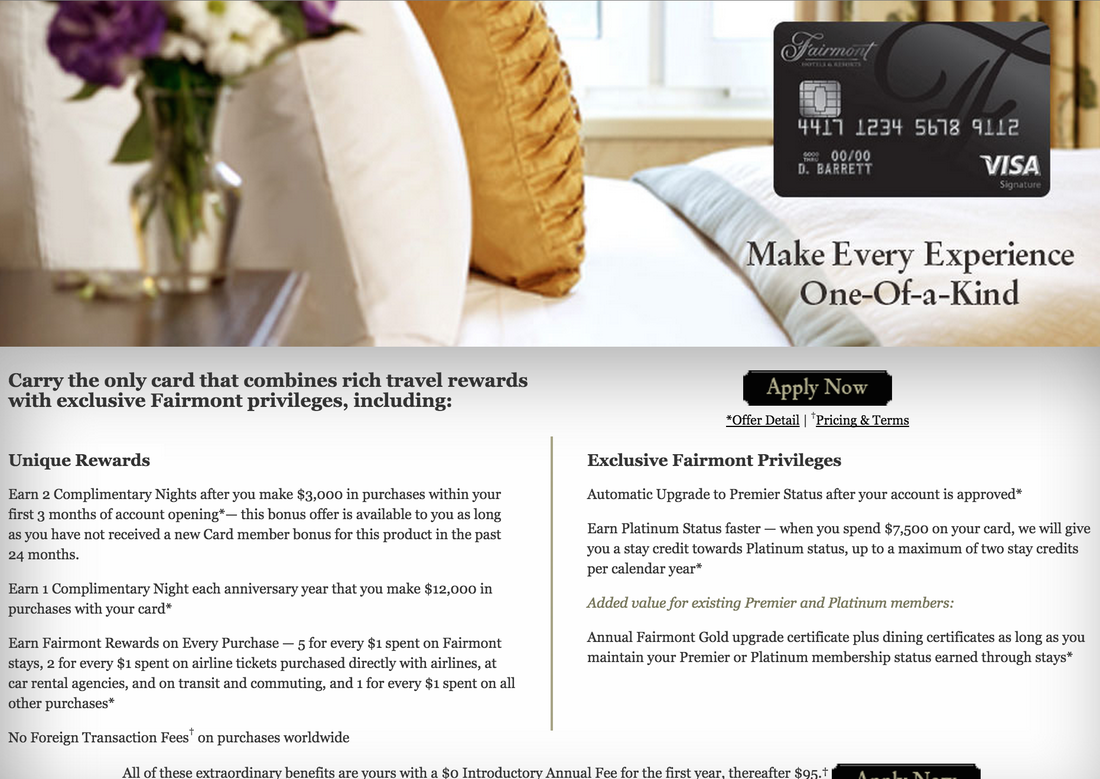

- We are very sad to see one of our favorite card for perks Chase Fairmont Visa has been discontinued for new applications due to Accor's acquisition of Fairmont, Raffles, Swissotel. Fairmont Visa has been offering an amazing signup bonus (two free nights, possibly in a suite, plus breakfasts) and is also one of the credit cards to keep paying annual fees without spending a dime.

- Chase Southwest Plus Visa's 50K offer is back. While the higher annual fee Southwest Premier Visa has been offering 50K, it has been a while since last time we saw Plus Visa's 50K offer.

- Citi has increased the signup bonus of Citi Prestige from 40K to 50K, while decreasing the signup bonus of the ThankYou Premier from 40K to 30K.

|

This is Sean, aka Dr. Credit Card. First of all, I would like to wish every reader of the site a happy 2017! It is pretty crazy that the last blog post was almost two months ago - I bought a new house and moved in recently and have been unable to keep up. Even though there have been updates on the site here and there, I wish more could have been done. Now we have been slowly settling in, the site should be back to normal. Here are some highlights of the recent updates.

4 Comments

Hello, this is Sean aka Dr. Credit Card. This is probably the most interesting post I have written since I started this website and blog in 2011. Most previous posts were about credit card offers, and a few were my analysis of value (and changes) of miles/points. I never really talked about how to use miles/points, since I figure that is really up to each individual to decide. What works for me might not work for you. However, I have been debating about that approach a lot. I was already touching on the value of miles/points quite a few times as it is inevitable, and each time I tried to make it clear that it was our valuation and “your mileage may vary”. Basically the value comes down to how much I would pay for an airline ticket or a hotel night if I don’t have miles/points, rather than how much the airline/hotel charges. For example, if a round trip long haul business class ticket retails at $6,000 but will cost 120,000 miles to redeem, my miles value is not 5 cents per mile ($6,000/120,000 miles), but rather 1.8 cents per miles since I am willing to pay ~$2,200 for that ticket. I have realized many of you got confused about that part, and I think sharing some personal experience may help you understand it better and also showcase how credit card offers could be extremely lucrative. Note that many of the programs I used in the examples have devaluated or were even discontinued after our trips, but I think the moral of the story is how credit cards enabled me and my family to have some amazing experience that we wouldn’t have afforded otherwise. Earning: 38 cards, 2.5M miles/points, and 12 free night certificates in five years In the past five years, between my wife and I we opened 38 new credit card accounts, and earned about 2,500,000 miles/points in 18 different programs, plus 12 free night certificates. These miles/points were all from signup bonuses and did not include the miles/points we earned through spending or other program promotions. Since 4 of the cards offered free nights in lieu of miles/points as signup bonus, we earned an average of ~74K miles/points per card for the remaining 34 cards. All these may seem a lot, we are not considered aggressive at all - we each opened about 2 cards every 6 months to ensure our credit scores stayed excellent - in fact our credit scores gradually improved over these years. There are many people out there, including some of our readers, opened much more cards per year. If you visit our Deals page, you will see that all offers we recommended have at least 40K miles/points bonus, and over the years there have been quite a few offers in the 75K-100K range. What I am trying to say here is that if we could do it, you can do it. Experience: long haul first class/business class flights, luxury hotel rooms/suites, and many amazing memories I will use some of our most amazing miles/points redemptions as case studies. They are not in order of time/card/program, but rather random.

© 2016 DrCreditCard.net All rights reserved.

We saw several major changes in the travel industry in late 2015, which certainly had and will continue to have major impact on the credit card market. Yes, we are talking about American Airlines’ award chart devaluation, Marriott-Starwood merger, and Accor’s acquisition of FRHI (Fairmont, Raffles, and Swissotel).

1. American Airlines’ Award Chart Changes On November 17, 2015, American Airlines announced several changes in its 2016 AAdvantage program, including massive devaluation in its award charts, which will kick in for awards booked on March 22, 2016 or later. To be honest, this wasn’t that surprising since in the past several years, American has had more lucrative award charts than its major competitors United and Delta, and we had anticipated that it would devaluate its miles after the merger with U.S. Airways. But the devaluation is still quite bad. The best redemption options under the old charts - longhaul business and first class awards are hit the hardest, as expected. The required miles on some of our favorite routes increase by 4%-27% for longhaul business class awards, and by 20%-63% for longhaul first class awards. Our value for American miles is thus adjusted from 1.8 cents per mile to 1.6 cents per mile, and obviously your mileage may vary. If you have a substantial balance of American miles, remember to book your flights before March 22, 2016. Let’s see how this affects the credit cards after March 2016. This obviously made Citi or Barclays AAdvantage cards (see Citi Platinum Select / AAdvantage, Citi Executive / AAdvantage, Barclays Aviator Red, Barclays Aviator Silver) less valuable in terms of earning miles; however, our recommendation for earning American miles through credit card spending has always been one of our Top Listers, Amex SPG, which returns 1.25 miles when transferring points to miles in bulks of 20K. Even though SPG still has 30+ other partners to transfer to, such as Alaska Airlines whose miles we still value at 1.8 cents per mile, the value of SPG points certainly take a hit with American’s devaluation. This combined with the fact that the SPG program will be no more within a couple of years (see section 2 for details) makes us adjust the value of SPG points to be 2.1 cents per point, down from 2.25. 2. Marriott-Starwood Merger On November 16, 2015, Marriott International announced that it would acquire Starwood Hotels and Resorts to create world’s largest hotel chain. This announcement was somewhat a surprise and will have a huge impact on the hotel industry in years to come. Obviously it will take some time for the two chains to integrate as well as their loyalty programs, and we expect that Marriott Rewards and Starwood Preferred Guest (SPG) will continue to run separately at least through 2016 and eventually will merge into one single program sometime beyond 2016. SPG is one of our favorite hotel programs out there not only for its elite benefits but also for its revolutionary redemption options including points transfer to 30+ airline partners at up to 1:1.25 ratio. For travelers who have a large balance, they probably need to start planning ahead to burn these points, since even though Marriott promise it would keep the value of SPG (points), we highly doubt that they will be the same level of value when SPG points eventually turn into Marriott points. For those who are not very sure of their value, our current valuation for these two currencies are: 2.25 cents per point for SPG, and 0.65 cent per point for Marriott. We don’t think when the two programs finally merge, SPG points will be turned into Marriott at 1: 1 ratio, but we expect it won’t be 1:3 either. However, for those who has a SPG points balance less than 150K, we will suggest not worrying about them too much, since it will be plenty of time to put them to good use. Now let’s look at the merger’s impact on credit cards. Firstly, as mentioned in section 1, our value of SPG points will be adjusted from 2.25 down to 2.1 cents per point considering American Airlines, one of the best transfer partners of SPG, will devaluate after March 2016, and the fact that you probably won’t be stockpiling SPG points as you might used to due to the uncertainty of this program beyond 2016. Secondly, Amex SPG, one of our favorite credit cards, not only returns slightly less value than before but will be completely nonexistent in a few years (it will probably be converted to another Amex product for existing customers). This will leave a huge hole that won’t be filled for a long time, since not only is Amex SPG a well-rounded product but also there will be one less program that allows flexible points transfer to airline miles. Please see our featured review SPG vs. MR. vs. UR. vs. TY vs. CR for this type of programs and you will see why we love them so much. Lastly, the impact on Chase Marriott and J.P. Morgan Ritz-Carlton credit cards will remain unknown. You may expect more hotels (SPG currently has 1,200+ hotels) be available for redeeming points, but we are not sure how SPG hotels will be categorized in Marriott’s system and if Marriott will again devaluate their points after the merger. You may expect the Gold or Platinum status earned through Ritz-Carlton Visa be more beneficial for similar reasons, but again we are not sure if Marriott will adjust the elite benefits after the merger. 3. Accor’s Acquisition of FRHI On December 9, 2015, AccorHotels announced that it would acquire FRHI, the parent company of Fairmont, Raffles, and Swissotel. Accor, which may be an unfamiliar name to a lot of Americans due to its very limited footprint in North America, is actually a giant in the hotel industry with near 3,800 hotels worldwide, including brands such as Sofitel, Pullman, MGallery, Novotel, Mercure, etc. Even though we haven’t know the timeline yet, we suspect that some time beyond 2016, Fairmont President’s Club will be integrated into Le Club AccorHotels. At that point, we will be very sad to say goodbye to one of our favorite hotel credit cards, Chase Fairmont Visa, which is also on the list of cards worth paying annual fees without spending. The generous signup bonus (two free nights at a luxury hotel with breakfasts, possibly in a suite), Fairmont Premier status (suite and room upgrades, third night free certificate, $50 dining/spa credit), an annual free night after $12K per year, and Lounge Club membership with two free passes per year, all contribute to this card’s uniqueness. If you haven’t had this card, we definitely recommend getting it before this program gets folded into Accor’s. Even if you had this card before, you may still get the signup bonus if the last time you received the bonus was more than 24 months ago per terms and conditions. Right now, we don’t know if Accor will partner with a U.S. financial institute to offer a co-branded credit card in the future but we think it is very likely. At that point, we will evaluate it and definitely hope it will be a competitive product. © 2016 DrCreditCard.net All rights reserved. This offer for Chase Fairmont Visa Signature with the 1st annual fee waiver has returned! You will need to spend $3,000 within 3 months to receive the two free night certificates that can redeemed at any Fairmont hotel worldwide. Free night certificates will expire after 12 months, and please visit this Fairmont page for blackout dates and special restrictions for The Plaza, The Savoy, and Fairmont Heritage Place properties. The annual fee is waived for the first year, saving $95. Please note that the free breakfasts (up to $50 per day for two days) that used to be part of the free nights are not mentioned in the current offer page; however, there have been reports that people still received the four $25 breakfast certificates (a total of $100 breakfast credit) with this offer.

Perhaps the most overlooked benefit of the card to new members is the complimentary Fairmont Premier status, which entitles you one room upgrade certificate, one suite upgrade certificate, two $25 dinner/lunch/spa certificates, and one third night free certificate (not combinable with the free nights) each year. When combining the signup bonus and Premier benefits, you will be able to stay two nights in a suite and receive up to $150 credit (four breakfast certificates and two dinner/lunch/spa certificates)! Examples of amazing redemptions include but are not limited to the newest member of the chain The Grand Del Mar in San Diego (where a suite can run you over $1,000 per night), Fairmont Kea Lani in Maui (where the basic room type is a suite that costs over $500 per night), Fairmont Orchid in Big Island Hawaii (suites from $800 per night), The Plaza in New York (rates from $500 per night, capacity control applies, only one certificate can be applied per stay and not combinable with the suite upgrade), Fairmont Chateau Lake Louise (suites from $800 per night), Fairmont Banff Springs (suites from $900 per night), and The Savoy in London (suites from $900 per night, capacity control applies). Landing Page Application Page © 2015 DrCreditCard.net All rights reserved. Chase has been keeping an offer with two free nights plus a waiver of the first year annual fee around for a while for its Fairmont Visa. Looks like that offer is gone. Now the best offer available is the standard two complimentary nights plus breakfasts (up to $50 per day). You need to spend $3,000 within 3 months to get the free nights and note that the spending requirement has been raised from $1,000.

Landing page for the standard Chase Fairmont two free nights offer (GONE) Chase Fairmont Visa waives 1st annual fee again && still two free nights upon signup6/14/2013 When Chase first introduced Fairmont Visa, the signup bonus was two free nights with a 1st year annual fee waiver. However, later on, Chase removed the annual fee waiver so that you would have to pay $95 to get the two free nights. Now, while the standard offer on Chase website still does not waive the 1st annual fee, there is a special offer through the following link that does come with the waiver.

There is no landing page, but just like the standard offer, you need to spend $1,000 within 3 months to get two free nights plus breakfasts for two (up to $50 per day). The Pricing and Terms at the bottom of the page does suggest $0 annual fee for the 1st year and $95 thereafter. The application page (expired) [Update 9/10/2012] Please note that Chase stops offering the 1st annual fee waiver ($95). You can still get two free nights plus breakfast for two (up to $50 per day) after you spend $1,000 within 3 months.

The new landing page The new application page [Original Post 6/12/2012] Oops, we forgot to put up the link to the Fairmont Visa signup offer: two free nights at any Fairmont hotel worldwide plus breakfasts for two after you spend $1,000 within 3 months. It also comes with the 1st annual fee waiver (saving $95). It is very similar to Chase Hyatt Visa signup offer but it includes breakfasts. The landing page The application page We have four new reviews out this week.

Bank of America's new BankAmericard Travel Rewards has the potential to earn 1.65x on general spending; BankAmericard Privileges with Travel Rewards has a $75 annual fee after the 1st year (there is a waiver if you qualify) and has the potential to earn 2.2x on general spending - now the latter is placed on our Top List. The new United MileagePlus Club Visa comes with free United Club membership, 1.5 miles per dollar spent - the highest earning rate for United miles from general spending, and a $395 annual fee. Citi finally enhanced its Platinum Select / AAdvantage cards and it was finally reviewed by us. The new Fairmont Visa is a great card for people who stay or plan to stay at Fairmont hotels. And what is more, the two free nights upon signup puts it right on our hot Deals page. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed