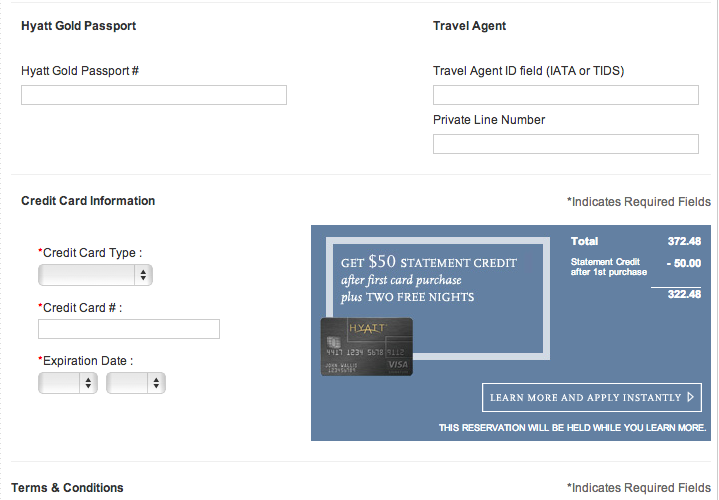

If you go to Hyatt.com and try to make a booking, before you fill in guest information, you will see a little picture suggesting that you will receive a $50 statement credit after the 1st use of the card. Note that you don't actually need to complete any reservation - just click on the "LEARN MORE AND APPLY INSTANTLY" button and proceed with your credit card application. In the next step you do need to enter your Hyatt account number to continue.

|

Chase has recently waived the annual fee on the Hyatt Visa for the 1st year - a saving of $75 for you. The standard signup bonus is still two free nights as always. You need to spend $1,000 within 3 months to earn the free nights. However, bad news for current Platinum and Diamond members - they don't get special signup benefits as they used to. Platinum members used to get two free nights plus two suite upgrades on paid stays while Diamond members used to get two free nights confirmed in a suite.

If you go to Hyatt.com and try to make a booking, before you fill in guest information, you will see a little picture suggesting that you will receive a $50 statement credit after the 1st use of the card. Note that you don't actually need to complete any reservation - just click on the "LEARN MORE AND APPLY INSTANTLY" button and proceed with your credit card application. In the next step you do need to enter your Hyatt account number to continue.

0 Comments

The temporary 60K offers have expired. Now Ink Bold and Ink Plus are back to 50,000 points. However, the spending requirement remains $5,000 (within 3 months), lower than the $10,000 requirement which has been around for a while. As always, the $95 annual fee is waived for the 1st year. Again since these two cards are considered two different products, you may get bonus for both.

Ink Bold 50K landing page Ink Plus 50K landing page [All four offers have expired]

For the Small Business Week (June 16 - June 22, 2013), Chase temporarily increases signup bonuses for its Ink Plus credit card and Ink Bold charge card from 50,000 points to 60,000 points each. Since they are considered two different products, if you sign up and get approved for both, you may earn 120,000 points in total. Also for each card, the spending requirement to get 60,000 points has been reduced from $10,000 to $5,000 within 3 months! Note that two other Ink cards - Ink Cash and Ink Classic will have a temporary 5,000 points bump each. Landing page for all four Ink Business Cards Application page for Ink Plus 60,000 points Application page for Ink Bold 60,000 points To frequent flyers/guests, 2013 is a bad year for hotel loyalty programs since several programs are having some major devaluation. You may have noticed that we seldom talk about how much we value miles and points since it is highly personal and subjective. However, this kind of major devaluation certainly has major negative impact on the hotel credit cards and we feel that we need to give some analysis here. We will go over the several hotel loyalty programs in this post.

Finally, let me share the new value we assign to one point in each program, and like always your value may vary:

Chase Ink Bold is on our Top List and has a generous 50,000 points signup bonus. Now as if it is not enough, Chase has the new Ink Plus Business Card which shares all the same great benefits as Ink Bold and the nice 50,000 points signup bonus. The only difference is that while Ink Bold is a charge card, Ink Plus is a regular credit card. The cool thing is that since Chase considers them as two different products, technically you can get 100,000 points if signing up both!

The 50,000 points bonus breaks down as: 25K after the 1st purchase and another 25K after you spend $10K within 3 months: Landing page Application page The old 50K offer has been pulled for a while and replaced with the new 40K offer. Open a new Chase Sapphire Preferred card (one of our Top Listers) Spend $3,000 within 90 days you will get 40,000 Ultimate Rewards points.

The landing page The application page [Update 5/15/12] Chase has made the Ink Bold 50K offer a little harder to achieve. The new offer is 25,000 points after the 1st purchase and another 25,000 points after spending $10,000 within 3 months. So basically you need to spend $5,000 more to get the full 50K.

The landing page The application page [Original Post 11/30/11] Ink only came out this May and yet Chase has decided to give it a facelift. We haven't got a chance to review Ink until around two weeks ago, and shortly after that we realized that Chase quietly changed the Ink Cards on its website. Please check out our updated review for details. Generally we are disappointed to see the changes; however we still recommend Ink since no doubt they are still among the best business cards in the market. Also while the link for the old Ink Bold 50K signup offer still works as of now, Chase continues to offer the 50K points for the new Ink Bold. The new Ink Bold 50K points offer (after spending $5,000 within first 3 months): The landing page The application page Chase Ink Bold Business Card now offers 50,000 points at signup after you spend $5,000 within 3 months. The first annual fee is waived ($95 saving). Ink Bold is on Dr. Credit Card's to-review list for a while and hopefully the page will be up soon. Our review is up [11/20/2011]. Note that Ink Bold, just like Sapphire Preferred, is part of the Premium Ultimate Rewards program and you can redeem 50,000 points for $625 in travel through UR or transfer them into BA/CO/KE/Hyatt/etc. miles/points. Please see our review on SPG vs. MR vs. UR for details.

The application link is here. Chase quietly added a list of 2x bonus categories, including dining, airfare, hotel, car rentals, travel agencies etc., to its Sapphire Preferred. The card used to be considered inferior to Amex PR Gold in our old review, now all of the sudden it almost becomes as good. Please check out our new review on Sapphire Preferred, a new Dr. Credit Card's Top Lister.

Please note that Chase is still offering 50K points as signup bonus. [Update 6/13/12] The offer with $75 credit is gone. But the original offer (at the end of the post) is still up.

[Update 5/15/12] There is a slightly better offer out there for the Hyatt Visa - two free nights plus $75 statement credit. Note that the 1st annual fee is still not waived, so essentially this credit offsets the annual fee. The landing page (DEAD) [Original Post 7/15/11] Chase Hyatt Card offers two free nights at any Hyatt hotels including the high-end Park Hyatt as the signup bonus. The nightly rate could be as high as $500 to $1,000. Bear in mind that you have to pay the $75 annual fee up front. The other way to look at this is that two nights means as much as 44,000 Hyatt points since the top-category Hyatt hotels require 22,000 points per night. Current Hyatt Platinum and Diamond members can get better signup offers. Please see our review on Chase Hyatt Visa for details. The landing page The application page |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed