- A few more recent good signup offers.

- Chase Sapphire Reserve now offers 80,000 points at signup - the second best offer after the initial incredible 100,000 points when introduced in 2016.

- Citi AA Executive WEMC offers 80,000 miles - the second best offer after 100,000 miles a few years ago.

- Barclays AA Aviator Business MC offers 80,000 miles + $95 credit - the historical high.

- Barclays Miles & More MC offers 80,000 miles - the historical high.

- With some changes in signup bonuses (we look at the historical trend in the recent couple of years) and rewards program valuation, our Top 10 list received some slight updates. Below is the before and after comparison. As you can see, Sapphire Preferred and Aeroplan MC switch places, while Hilton Aspire Amex replaces Barclays JetBlue Plus as the No. 10 card on the list.

|

1 Comment

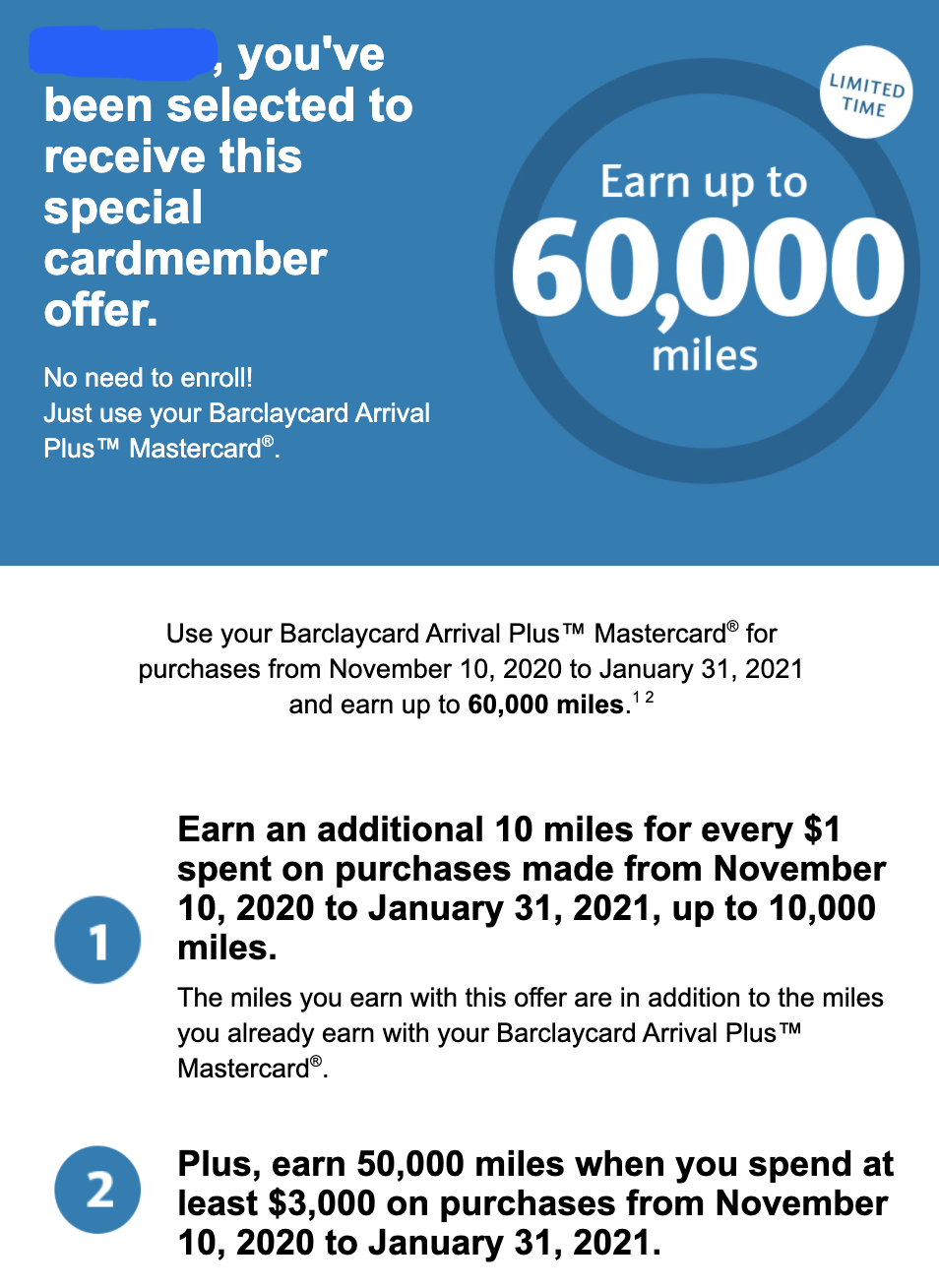

Throughout this pandemic when many card issuers have been bringing temporary benefits or bonuses to keep their existing cardmembers, Barclays has been quiet, until now.

In the last couple of days, many Barclays cardmembers received a promotional email titled "Double Bonus Opportunity – Earn up to 60,000 miles!" or "...60,000 points!" or "...$600 Uber Cash!" This appears to be a widely targeted offer to all Barclays cards such as Arrivals cards, AAdvantage Aviator cards, JetBlue cards, Hawaiian Airlines cards, Wyndham cards, Uber card: between 11/10/2020 and 1/31/2021, you will earn up to 60,000 miles/points or $600 cash, depending on which card you have (e.g. 10x additional points on everything, up to 10,000 points earned, and additional 50,000 points when you spend a total of $3,000 within this period). This must be the best bonus ever for existing cardmembers since I started writing about credit cards in 2011; usually you need to open a new account and meet the minimum spending requirement to receive a bonus like this; mostly likely the existing cardmembers did receive a similar bonus when they opened the card, and now it is like receiving a second bonus to keep the card. Sine June, Citi has been sending out emails to customers regarding the huge protection benefit change kicking in as of September 22, 2019. Curiously I personally haven't received any email from Citi regarding this topic for any of my Citi cards - Prestige, DoubleCash, and ThankYou Preferred. Maybe it was a glitch (for quite a few of us). For whoever that haven't received email notifications, when you log into your Citi online account and go to the "Card Benefits" page, you will receive a pop up window with the exact same message as what is supposed to be in the email. However, after you have viewed the message once, you won't see it again if you log back in. Talking about being sneaky!

For example, on my Citi Prestige, I received the following message: "Effective September 22, 2019, Worldwide Car Rental Insurance, Trip Cancellation & Interruption Protection, Worldwide Travel Accident Insurance, Trip Delay Protection, Baggage Delay Protection, Lost Baggage Protection, Medical Evacuation, Citi® Price Rewind, 90 Day Return Protection, and Missed Event Ticket Protection will be discontinued and will no longer be provided for purchases made on or after that date. Coverage for purchases made before that date will continue to be available, and you may continue to file for benefits in accordance with the current benefit terms. Roadside Assistance Dispatch Service and Travel & Emergency Assistance will be discontinued and will not be available on or after September 22, 2019. We are making these changes so that we can continue providing the key benefits that our customers use and value most at no additional cost. This change requires no action on your part. See FAQs under Card Benefits for answers to Frequently Asked Questions regarding these changes." This is absolutely the worst devaluation of benefit/protection we have seen in the history of not only Citi cards but all credit cards. Different card products may show different messages. It appears that after the devaluation, only a few protection benefits are left:

We used to praise Citi cards for the extraordinary protection benefits, especially on the premium products. Citi Prestige and Citi AA Executive are tied as #1 card for protection, and Citi Premier and Citi AA Platinum are tied as #4. This surely will change after September 22, 2019. In fact, ironically, Citi is going from the very top to the very bottom with regards to protection! Stay tuned for the new Top 10 lists. What can you do now? If you think about cancelling your Citi card(s), I won't blame you. As always, I will recommend keeping the card if it is one of your oldest cards to preserve your credit history. It will also be good to keep non-fee cards such as Double Cash or Citi Costco Visa, if you enjoy their rewards. If you have some purchases to make in the near future anyway, you probably want to make the purchases before September 22, 2019 to at least enjoy the protection such as Price Rewind, Return Protection, Extended Warranty, etc. If you have a premium card you are paying annual fees on, you really need to sit down and reevaluate your situation. There are some recent updates as the following and we are also working on updating several other card reviews.

Citi has further increased signup bonuses on its AAdvantage Platinum Select credit cards:

Barclays American Airlines Aviator Red WEMC has increased the signup bonus from 50K miles to 60K miles (the best ever offer), still just after your make the first purchase (which is very rare these days). Our review has been updated too to reflect the post- Amex SPG discussions (see below).

The Facts

The Math In the past we used to not recommend this card for general spending, as the old Amex SPG (before August 2018) returned 25% more AA miles than any AA cobranded cards. Effective August 2018, AA cobranded credit cards have become the best way of earning AA miles via credit card general spending. AAdvantage Aviator Red vs. AAdvantage Aviator Silver: Aviator Silver is $100/year more expensive than Aviator Red, and it comes with three premium features: (1) a 3-2-1 earning structure vs. 2-1 on Red (one additional mile on American, hotels, and car rentals), (2) EQM earning potential with $25K-50K spending, and (3) annual $99 companion certificate with $30K spending. Even if you don't use the last two, you just need to spend $6,250 a year on American airlines, hotels and car rentals to come ahead of the $100 difference in annual fees if you happen to value an AA mile at 1.6 cents a piece like we do, as $6,250 x 1 mile/$ x 1.6 cent/mile = $100. Of course, if your value is different, you can do your own math. The bottom line is that if you are a frequent American flyer, you will most likely find upgrading to Silver Aviator a great deal. AAdvantage Aviator Red vs. Citi AAdvantage Platinum Select: These two cards are direct competitors - they share many features. Their differences are: (1) Citi's version has a $99 annual fee ($4 more than Barclays') but waives it for the first year; (2) Citi's version offers 2x dining and gas; (3) Citi's version offers Reduced Mileage Awards (saving 7,500 miles on select routes); (4) Citi's version offers $100 flight discount after $20K annual spending; (5) Barclays's version offers 3K Elite Qualifying Dollars after $25K annual spending. The Conclusion Barclays designs the replacement of US Airways MasterCard to align with Citi's counterpart. However, if you frequent American or just have big hotels/rental cars spending, you will find upgrading from Aviator Red to Aviator Silver very rewarding. Citi has brought back the 75K-miles signup bonus for American Airlines AAdvantage Executive WEMC, which carries a $450 annual fee but offers full Admirals Club membership for the primary cardholder and access to 40+ domestic/international AA lounges for the authorized users plus two guests. Our value for the signup bonus after considering the first year annual fee is $750. For details see our review.

The new benefits of Citi American Airlines AAdvantage Platinum Select World Elite MasterCard (what a long name) kick in today for existing cardmembers: gas & dining as 2x bonus categories and an annual $100 flight discount after $20K spending; the annual fee is increased from $95 to $99, still waived for the first year. The expanded bonus categories give this card a boost in scores which enables the card to land on our Top 10 Best Credit Card list as #8 and bumps Chase United Airlines Club Visa Signature off the list. BTW, the Top 10 List will be going through major changes in the coming month considering the revamp of SPG and Marriott affiliated credit card products and the reduction of Citi's travel and consumer protection. Stay tuned.

The card offers either a 60K-mile bonus or a 50K-mile +$200 credit bonus. The 10% rebate for awards bookings, up to 10K miles per year, along with other travel perks such as free first bags, priority boarding, 25% onboard discount, have made the card a keeper after the first year. Now with the newly added 2x bonus categories and Amex SPG's reduced points earning starting August, this card becomes a must-have if collecting American miles is your primary goal concerning credit cards. For details see our updated review. August 31, 2017 Update - Barclays AA Red 60K, Chase Southwest 60K, Chase 5/24 rule explained8/31/2017 We have been continuing making updates throughout the site, and here are some highlights:

August 6, 2017 Update - Citi Executive AA 75K, Synchrony Cathay Pacific 50K, CNB Crystal 50K, etc.8/6/2017 We have been making updates throughout the site in the past couple of weeks. Here are some highlights:

|

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed