- BofA Alaska Airlines Visa received a revamp with a historical best offer of 70,000 miles + $99 companion pass.

- Delta introduced a new perk for all its cobranded cards (Delta Gold Amex, Delta Platinum Amex, Delta Reserve Amex): 15% off miles for awards travel on Delta flights.

- Amex elevated signup bonuses on all the Hilton cobranded cards: 100,000 points for Hilton Amex, 150,000 points for Hilton Surpass, and 165,000 points for Hilton Business Amex.

- Capital One rebranded Spark Travel Elite as Venture X Business Card, which shares almost all the features as the personal Venture X Card.

- Chase Aeroplan Visa saw another 100,000 miles offer, but with a high $20K spending requirement.

|

Not that many exciting new signup promotions recently, but we still keep making updates throughout the site. Here is a summary of some important updates.

0 Comments

COVID-19 pandemic has obviously changed consumer behavior big time, and it makes sense that credit card issuers are making adjustments accordingly. This post summarizes these adjustments from Amex, Chase, and Citi.

American Express

Chase

Citi

As detailed in the previous post, Amex has revamped all six Delta SkyMiles credit cards as of January 30, 2020. Now we have updated the following reviews to reflect the changes:

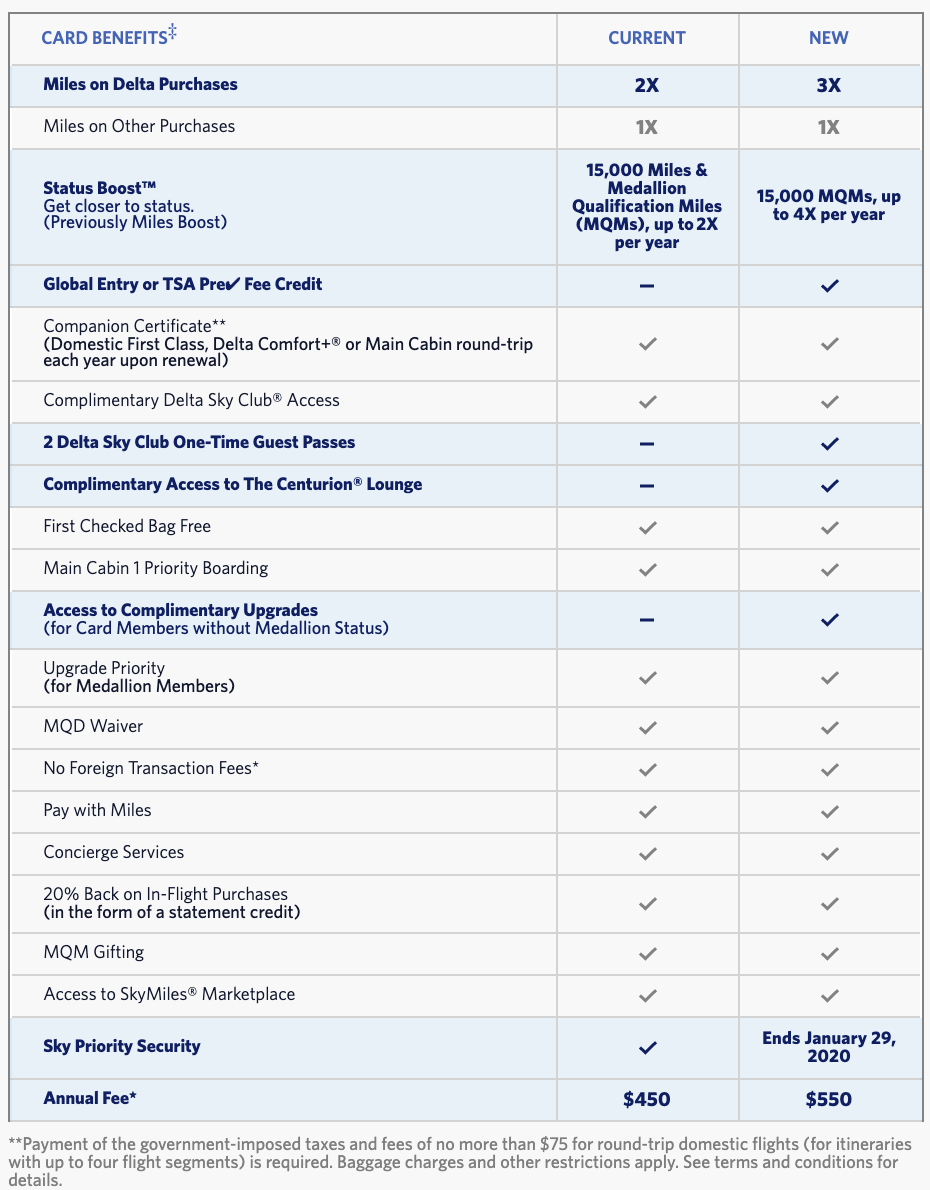

Note that with increasing annual fees, Delta Reserve Card and Delta Platinum Card both offer incredible Delta perks such as airport lounge access (Delta Reserve only), annual companion certificate, Delta Medallion Qualifying Miles booster, Delta Medallion Qualifying Dollar waiver, first checked bags for free, priority boarding, etc. That is why Amex Delta Reserve Card is now #3 (up by one) and Amex Delta Platinum Card #8 (up from #10) Best Credit Cards for Perks. In addition, Amex also introduced some impressive signup offers for these cards:

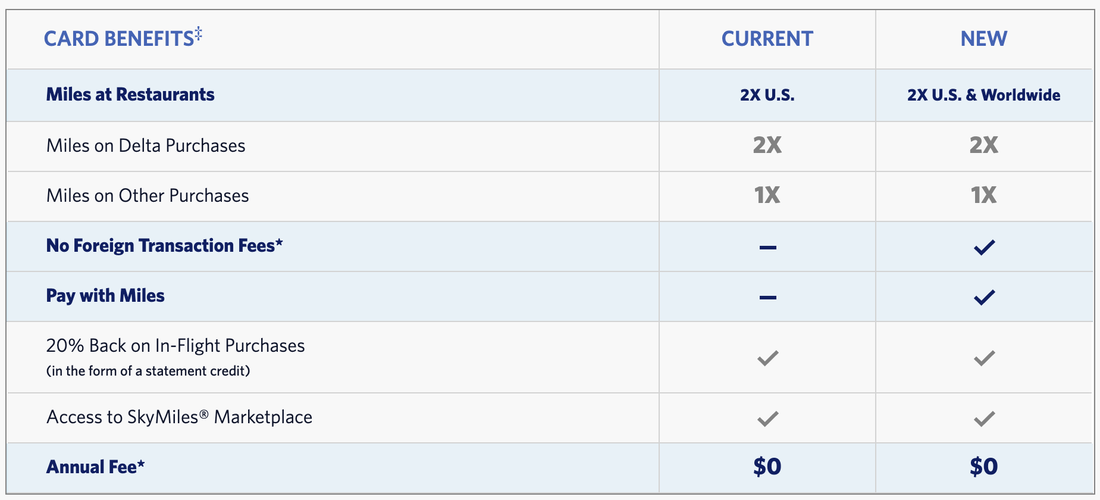

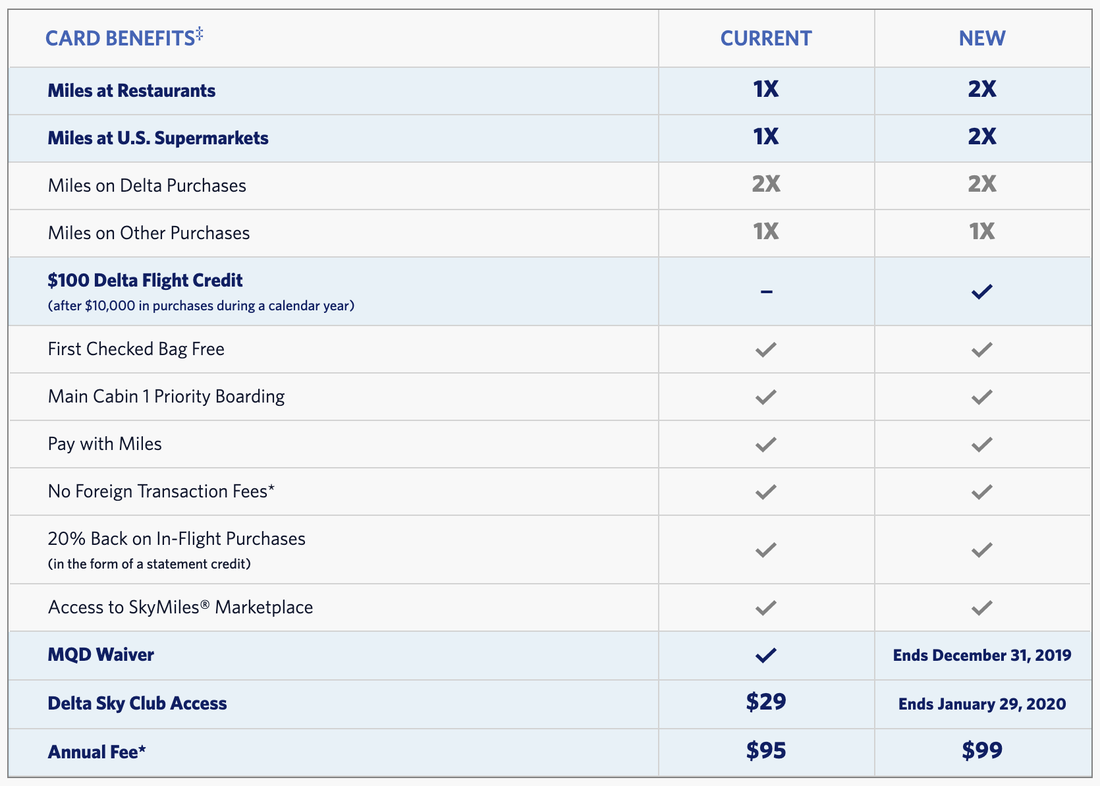

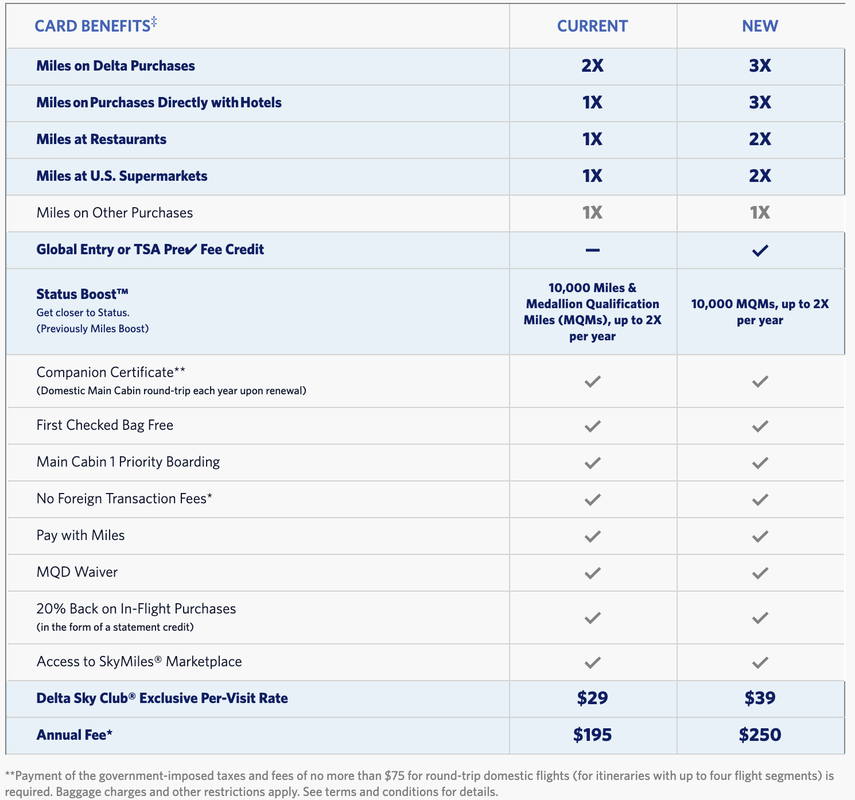

The major revamp of all seven Delta Amex credit cards are on the way. Let's have at a breakdown of the changes. All the tables are from American Express / Delta Air Lines. Delta SkyMiles Blue American Express

Delta SkyMiles Gold American Express

Delta SkyMiles Platinum American Express

Delta SkyMiles Reserve American Express

Three business cards also receive similar changes. Here we highlight the differences from personal cards.

After Citi's September overhaul and Barclay's November overhaul of their credit card protection benefits, Amex will also have some major changes coming on January 1, 2020. Here are the breakdowns of the upcoming changes.

Overall, the changes are mixed - some gain and some loss - but not as bad as Citi's drastic devaluation. The cards that benefit from the changes are probably limited to those with an annual fee at least $450 - Platinum Card (personal and business), Delta Reserve (personal and business), Hilton Aspire, and Marriott Bonvoy Brilliant; the rest of the cards are generally considered to receive reduced coverage. We think most cardholders will be unhappy about the changes. We will update our Protection page once these changes kick in. This week we have seen some elevated signup bonuses on a few credit cards (our value for the bonus minus first year annual fee is for your reference - your valuation may vary):

This is not the first time Amex runs this kind of promotions for its Delta cobranded SkyMiles Credit Cards, and won't be the last one. Now through 9/19/18:

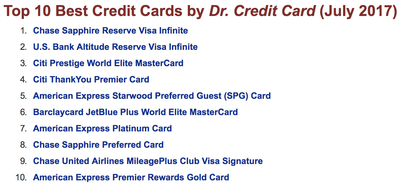

As our current valuation for Delta miles and its MQMs are around 1 cent a piece, the signup bonus after considering the first year annual fee for either of these four cards is roughly $600. Alliant Credit Union Visa Signature, which carries a $59 annual fee and offers unlimited 3% cashback for the first year and 2.5% cashback thereafter, was introduced earlier this year, but I haven't got a chance to write the review and crunch the numbers until recently. After Year 1, you need to spend $11,800 a year on this card to beat a 2% cashback card with no annual fees, such as Alliant Visa Platinum Rewards, Citi Double Cash, or Fidelity Visa, as $11,800 x (2.5 - 2)% = $59. If your have large annual spendings, this card is hugely lucrative - for example, if your annual spending is $100K, you will earn an additional $440 over a 2% card after considering the $59 annual fee. After I put this card through our analysis considering all four "P" factors, this card becomes the #2 Best Credit Card for Rewards and #9 Best Credit Card by Dr. Credit Card. Even though we are sad to see one of our longtime favorite Amex Premier Rewards Gold dropping out of the Top 10 list, the more competition the better for the consumers. If you ever wonder if Alliant Visa Signature is the best cashback card out there when you spend at least $12K a year, there are a few options you may want to look into:

The bottom line: for most consumers, Alliant Visa Signature is the "King of Cashback". We could only hope that it won't be dramatically changed in the near future. Of course, we have been making other updates throughout the site. For example, early this week Amex has again brought back limited time offers for the four Delta SkyMiles Amex Cards: personal and business Gold (60K miles + $50), personal and business Platinum (70K miles + 10K MQMs + $100). © 2017 DrCreditCard.net All rights reserved. We have been continuing to make updates throughout the site. Here are the highlights of the week.

Amex Blue Business Plus now replaces Amex Blue Business as the entry level Membership Rewards (MR) business card, with no annual fees. Not only does it offer better rewards for most consumers - 2x (up to $50K spent per year) vs. 1.3x MR points, but it allows points to be transferred to frequent traveler miles/points without another premium MR card. Amex Blue Business Plus is the first card ever that returns 2x points for general spending while allowing frequent traveler miles/points transfer. Previously, the best cards of this type (earning SPG, MR, UR, TY, etc.) "only" return 1.5x points: Freedom Unlimited (no annual fee) returns 1.5x UR points but requires another premium UR card to allow miles/points transfer; Amex EveryDay Preferred ($95 annual fee) returns 1.5x MR points with a requirement of at least 30 transactions per month. Based on our current valuation of MR points at 1.5 cents a piece, the Blue Business Plus returns an impressive 3% travel rewards for general spending; the only downside is that the 2x applies to the first $50,000 spent each year. Please see our Amex Blue Business Plus review for details. We are now even calling this no-fee card the "King of Business Cards" due to its lucrative rewards potential.

UBS has joined the already (over) heated high-end credit card market, with its Visa Infinite credit card. Its 3-2-1 rewards structure competes well with its competitors, and while the maximum value is 1.8 cents per point (cpp), our more realistic valuation is around 1.5 cpp. However, bear in mind that these points can not be transferred to frequent traveler points/miles, as in the case of its major competitors, Chase Sapphire Reserve, Citi Prestige, Amex Platinum. Please see our UBS Visa Infinite review for details. While it could be potentially rated high on our Top 10 Best Credit Cards list, as UBS's intention is to cater for its ultra affluent clients, we need more time to evaluate how easily accessible it is to regular consumers. Now if you are not a UBS client, you have to call the 800 number and request an application to be mailed to you. We have been continuing to make updates throughout the site, including an updated review for Delta SkyMiles Amex Cards with enhanced signup bonus (60K for Gold versions, 70K for Platinum versions) © 2017 DrCreditCard.net All rights reserved. |

AuthorDr. Credit Card helps you to find the best cards and the best signup deals for you! Archives

May 2023

Categories

All

|

RSS Feed

RSS Feed